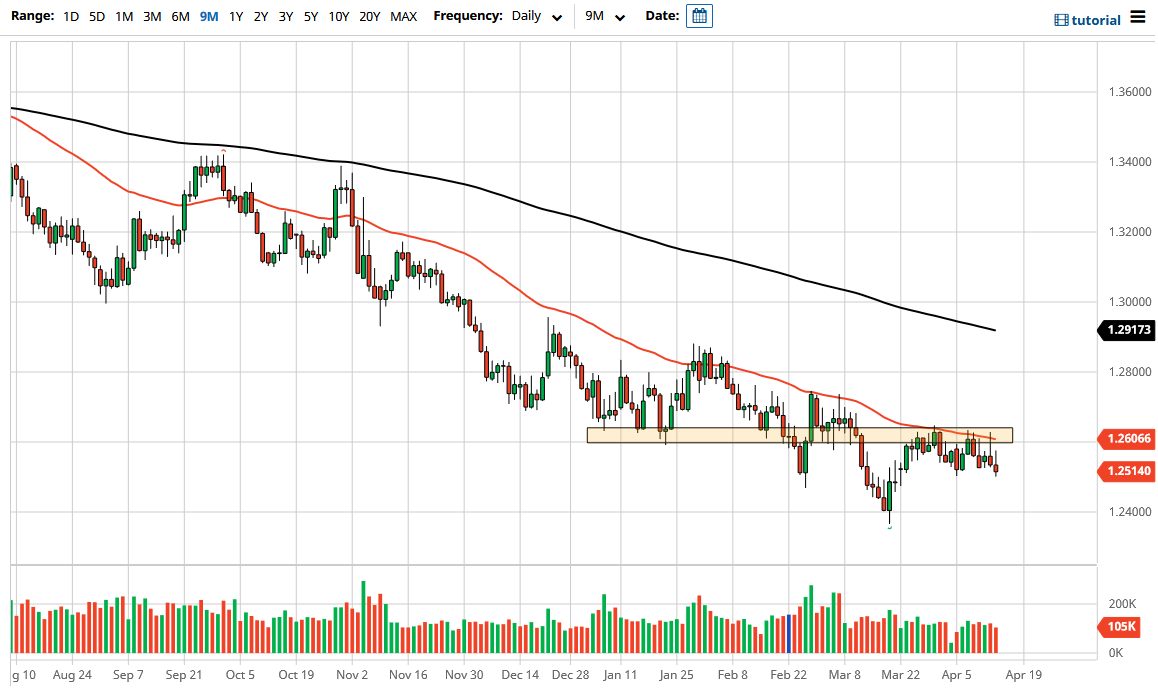

The Canadian dollar fluctuated during the trading session as oil broke out. What I find interesting is that even though the crude oil markets broke down significantly, the Canadian dollar was essentially unchanged. While at one point during the trading session it looked like we were going to have a major breakdown, the reality is that the Loonie did not act as you would expect. At this point, it makes you wonder whether or not there is more downside.

I am not saying that we cannot break out; obviously we can. But having said this, we have clearly seen a lackluster performance from a currency that should have been one of the best performers of the day. This was especially true towards the end of the session when people closed positions quite quickly. I do wonder whether or not we are trying to form some type of longer-term basing pattern, which would also explain why trading this pair has been so difficult as of late. We have been chopping around quite a bit, so I think it makes sense that we would continue to struggle. When you see this type of behavior, a lot of times it can be the end of the trend, but that is normally a very messy affair.

If we break above the highs of the last couple of sessions, I think that could be a real problem for the Canadian dollar going forward. On the other hand, if we break down below the lows of the trading session on Wednesday, then the pair should drop towards the 1.25 handle, followed by the 1.24 handle. Long term, it still a bit of a question, mainly because the oil connection failed to live up to billing during the trading session. With that being the case, I find that this market is one that needs to make up its mind before we start putting a lot of money to work. Clearly, the trend is lower, but the action as of late has not been the typical action you will see in this pair, and that is something that should have you paying close attention. Volatility is probably the one thing that you can count on, as this market is clearly chopping around looking for some type of longer-term signal or impulsive candlestick.