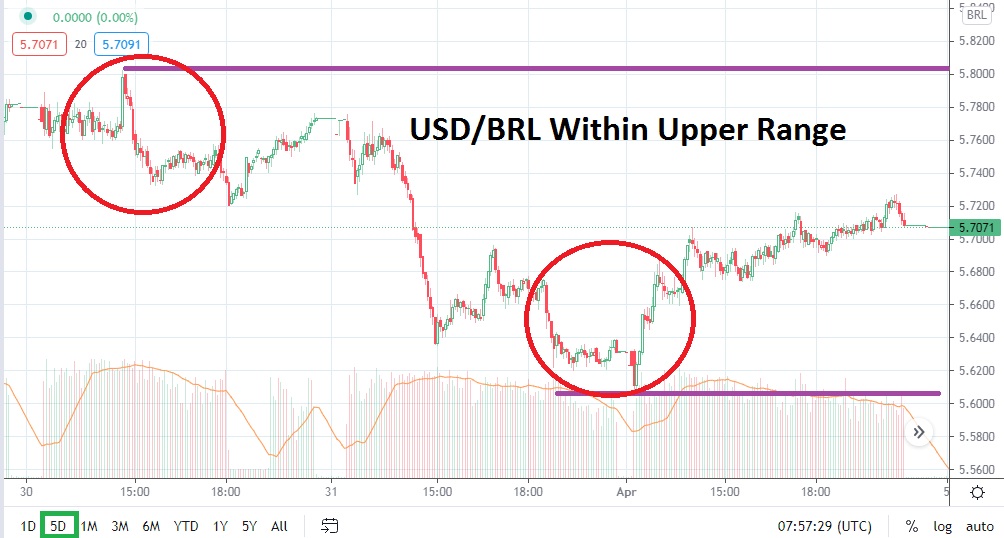

Short-term traders of the USD/BRL will face another test of their perceptions today as the Forex pair touches higher values and is within technical sight of its upper range. Brazil continues to be dogged by questions regarding the handling of coronavirus and its impact on the nation’s economy. Technically, the USD/BRL has failed to produce any type of significant long-term bearish trend, which also does not correlate to the results of the broad Forex market against the USD.

On the 8th of March, the USD/BRL was trading near the 5.8800 level. Today’s price of nearly 5.7000 may feel rather far away from the upper reaches, but a look at a one-month chart brings into focus the technical question of a potential retest of highs emerging. While trading volumes will likely be light today as many investors enjoy a long holiday weekend, speculators may have an opportunity to place trading positions which may benefit from a storm of transactions when full volumes resume.

On the 31st of March, the USD/BLR was trading near the 5.6100 level which failed to retest lows of 5.5800, which may have made technically bearish traders emerge. The inability of the USD/BRL to reignite sustained trading downwards and challenge its lower support range is beginning to take on the look of an incremental bullish trend. When the USD/BRL hit the 5.8700 mark approximately on the 8th of March, a reversal downward did occur and a low water price of 5.4400 was touched on the 19th of March.

However, the USD/BRL continues to show it has power towards higher values. Technically, the next few days of trading will be intriguing, because if higher short-term resistance proves vulnerable and the 5.7300 to 5.7700 junctures do not prove adequate, speculators may suspect that a test of early March values could develop.

Buying the USD/BRL on slight dips, which test nearby support marks, may prove the best speculative wager short term. If the price of the USD/BRL continues to sustain itself above the 5.7000 ratio, this could set off alarm bells among speculators and investment houses, who may be inclined to believe that the weakness of the Brazilian real will continue and new highs will be challenged.

Brazilian Real Short-Term Outlook:

Current Resistance: 5.7300

Current Support: 5.6850

High Target: 5.7700

Low Target: 5.6550