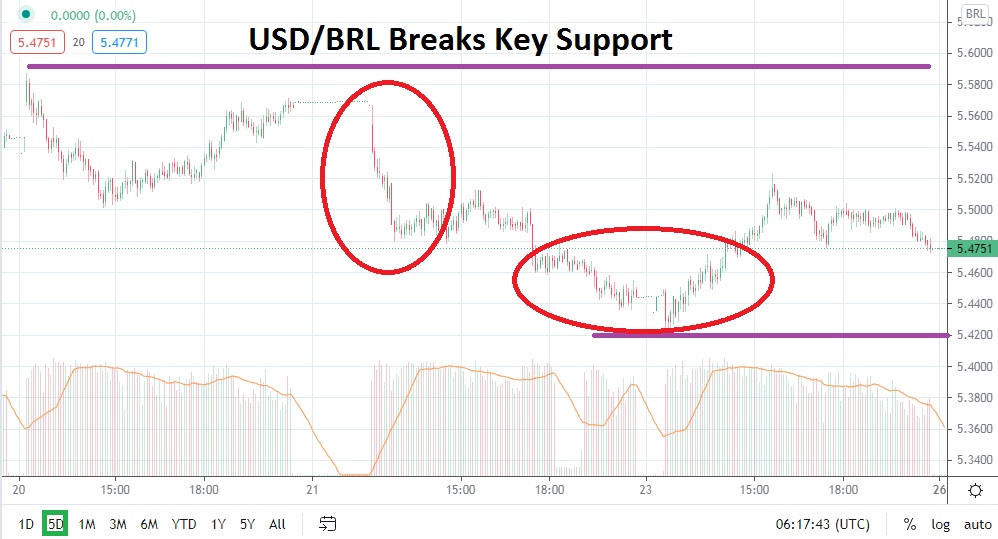

The USD/BRL has punctured important mid-term support, and traders may be actually considering the temptation that a bearish trend has emerged. Since last Thursday, the USD/BRL has gone from a high of approximately 5.5800 to its current vicinity near 5.4750. The ability to break below the price of 5.5000 is important psychologically. If the USD/BRL can sustain values below this level, traders may begin to contemplate a price range not demonstrated since February.

The question speculators need to decide upon before they make their next trading decisions is if the latest results within the USD/BRL are a good area to seek reversals higher, or it the recent bearish cycle will turn into legitimate momentum which proves durable. Support near the 5.4400 to 5.3900 junctures must be watched closely. The USD/BRL tends not to be a fast mover, but its trading late last week did produce some velocity.

Traders looking for more downside momentum should keep in mind the last time the USD/BRL traded below the 5.4300 ratio with any sincere amount of price action was in late February. Technically, if the USD/BRL approaches this support level, it could inject a dose of volatility into the USD/BLR and programmed trading from financial houses may provide an added speculative element.

Traders who do not believe that the USD/BRL can actually puncture support levels lower in the short term, and expect to see reversals higher produced cannot be faulted. These speculators may simply choose to place buying orders slightly below the current market price and then aim for resistance, which is within close reach for quick-hitting trades. The USD/BRL has proven reversals are part of the trading landscape frequently at its current values before. On March the 23rd, the USD/BRL was trading near its current values before it sparked bullish momentum which eventually took it to a high of nearly 5.8000 on the 29th of March.

However, this time may prove to be different within the USD/BRL cycles of value. Risk appetite may be showing a greater amount of optimism regarding the Brazilian real and this may help to spur on more bearish sentiment within the USD/BRL. Traders who decide to sell on slight moves higher within the Forex pair may be making a worthwhile wager while aiming for current support levels.

Brazilian Real Short-Term Outlook:

Current Resistance: 5.4970

Current Support: 5.4500

High Target: 5.5500

Low Target: 5.3900