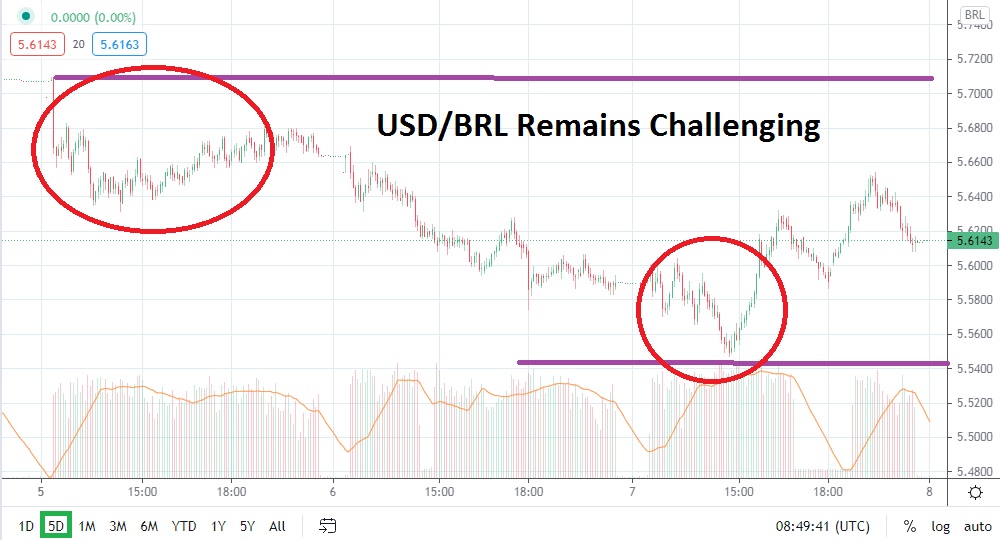

The USD/BRL has been able to demonstrate a slight move down the past couple of days. Having been within the upper part of its value range most of March, the USD/BRL has been able to come off of higher values and offers speculators an opportunity to test its momentum. Traders need to be patient with the USD/BRL, as it does produce volatility, but it often occurs in rather incremental steps compared to many other major Forex pairs.

Brazil continues to suffer from a relentless amount of negative news regarding coronavirus, but it must be stated that the USD/BRL has proven to be rather resilient and this should encourage speculators of the Brazilian real. Political ramifications will certainly have an impact on economic outlooks for Brazil, but in the short term, the USD/BRL continues to trade in a steady manner. Technically, the USD/BRL has not produced long-term bearish momentum like many other major currencies, but the ability of the Brazilian real to remain within its current value range may help Brazil economically regarding its large export businesses.

Technically, the USD/BRL is traversing above intriguing support, which has proven rather durable since the middle of March. The USD/BRL continues to move in a rather incremental manner where values must be derived by speculators within mathematical so-called ‘pips’ often.

Looking for massive moves within the USD/BRL is not the road to quick riches in most cases for speculators unless vast sums of leverage are being used. Traders need to use risk management when maneuvering within the USD/BRL, but their approach needs to make sure they understand the dynamics of the Forex pair, which are different compared to many others taking into consideration volatility factors.

Support near the 5.5900 to 5.5800 ratios may look extremely close, but the USD/BRL sometimes moves in slower trajectories. The use of limit orders and having patience is often required when trading the USD/BRL. The ability to place take-profit and stop-loss ratios rather close to the current price of the USD/BRL after a position has been opened, however, makes trading the USD/BRL appealing as a speculative Forex pair.

The USD/BRL remains seemingly within the higher ratios of its mid-term range. Speculators may feel inclined to actually sell the USD/BRL and look for short-term moves downward which challenge nearby support levels. If lower support ratios are touched, looking for a reversal higher to occur also makes sense.

Brazilian Real Short-Term Outlook:

Current Resistance: 5.6350

Current Support: 5.59500

High Target: 5.6640

Low Target: 5.5550