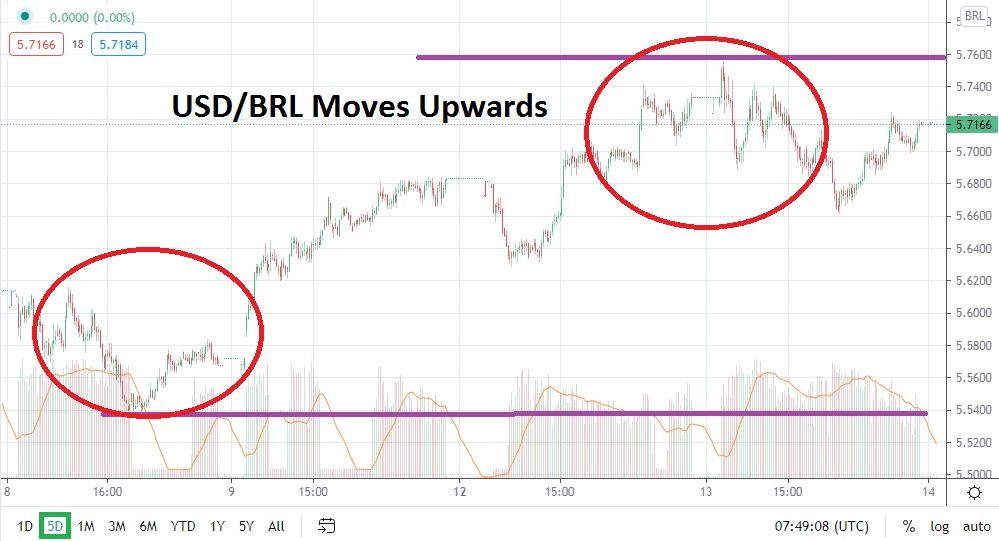

The USD/BRL finds itself this morning near important mid-term resistance levels. Since late last week, the USD/BRL has reversed higher after testing short-term lows. As of this writing, the USD/BRL is traversing above the important 5.7000 ratio and, if the value of the Brazilian real is sustained near its current price, speculators may contemplate highs achieved the end of March when the 5.7700 mark was tested.

However, speculators must also acknowledge that the USD/BRL trades in rather slow, incremental waves. While the USD/BRL is certainly traversing higher values, the pair does not produce exceptionally fast results. Traders who want to be buyers of the USD/BRL should likely not target the highs of March, and should instead aim for nearby values without being too greedy.

The USD/BRL remains within the upper realms of its mid-term range. In the second week of December, the USD/BRL was trading near the 5.0000 vicinity and has incrementally climbed higher since this time period. Traders may continue to remain bullish regarding the USD/BRL and look for moves higher while using nearby support levels as stop losses.

Traders of the USD/BRL need to be patient and understand that the forex pair is not trading in a correlated manner compared to many of the major Forex pairs against the USD. Economic concerns regarding the extent of coronavirus implications in Brazil continue to cast a shadow over the nation. Technical traders have a clear trend to take advantage, but they should also consider the potential for small reversals lower which do happen.

Current support near the 5.68000 juncture appears to be strong, and cautious traders may want to use this as an entry point for buying positions of the USD/BRL. However, because the USD/BRL moves rather incrementally, speculators who are more aggressive may want to use the 5.7000 level as a location to enter the market with buying positions.

Short term, the USD/BRL continues to exhibit an ability to prove moves downward are not long lasting. Speculators who continue to wager on buying positions may wonder how much higher the USD/BRL can go taking into consideration it is approaching important mid-term resistance, but trading against the bullish trend which has been predominant since the middle of December may not prove productive.

Brazilian Real Short-Term Outlook:

Current Resistance: 5.7300

Current Support: 5.6830

High Target: 5.7750

Low Target: 5.6590