The USD/ARS continues to create new highs on a steady basis and the rocket ship upwards is unlikely to stop in the short or mid-term. Traders need to have patience, make sure they are not over-leveraged and that they can maintain and pay the transaction fees which they may be charged for carrying the USD/ARS overnight to take advantage of the bullish momentum.

Argentina remains an economic mess and the acting government is more concerned about appearances and maintaining power than actually dealing with the economic crisis creating hardships for its citizens. The refusal to deal with reality and insist on rhetoric which attacks and blames opposition entities within Argentina is troubling. The current government’s appeal to its people to cast the blame on outside forces too, like the IMF, is nothing new either.

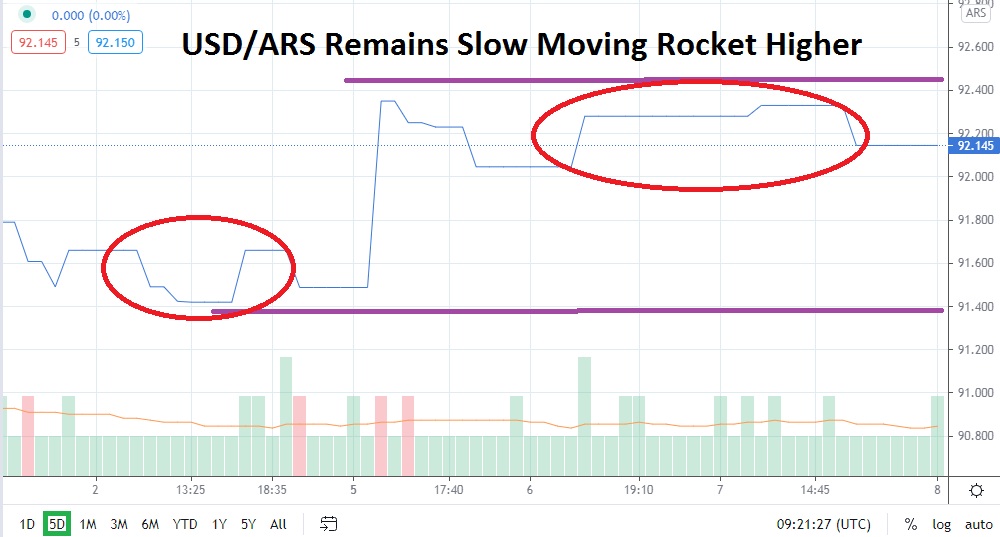

The USD/ARS is now trading above the 92.000 level and resistance if it can legitimately be called that appears to be above the 92.380 mark. Yes, the USD/ARS does on occasion produce reversals lower which should be paid attention to by traders, and underscores the need for limit orders when pursuing buying positions of the Forex pair. However, the consistent ability of the USD/ARS to traverse higher is not a technical illusion and it will persist until the facts on the ground economically change in Argentina.

Unfortunately, Argentina shows a historical disregard for change regarding corruption and misappropriation of money. The USD/ARS value quoted via trading platforms is not the actual rate of exchange that is taking on the place on the streets of Argentina. The black market rate for the USD/ARS is nearly double the current official amount listed.

Simply put, traders that can buy the USD/ARS and hold are making a rather secure speculative wager if they are patient and can tolerate carrying charges. Resistance levels continue to look weak and are brushed aside on a consistent basis. The 92.400 mark up above is within sight for traders and they are reminded to use take-profit orders and not let their trading positions linger too long. The ultimate journey higher for the USD/ARS appears currently to have no end, and it can legitimately be asked when the Forex pair will hit the 100.000 juncture. Time will tell.

Argentine Peso Short-Term Outlook:

Current Resistance: 92.380

Current Support: 92.000

High Target: 92.430

Low Target: 91.800