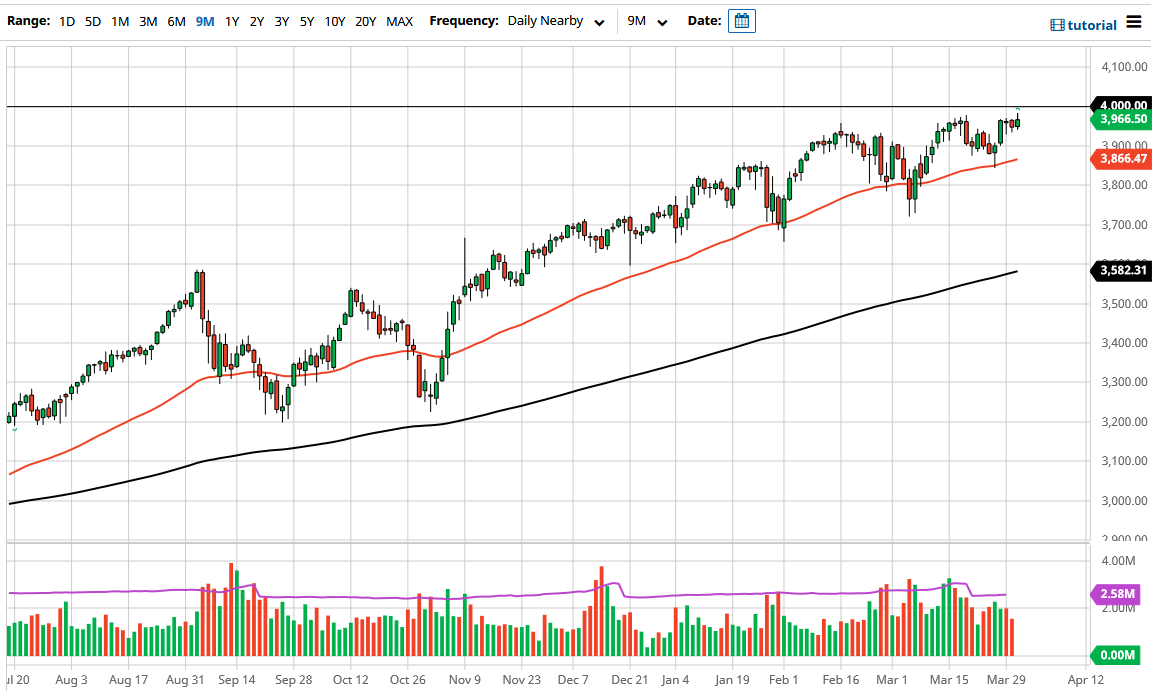

At the end of the day on Wednesday, the market did try to break out to the upside but gave back the gains to sit in the same general vicinity that we have been in over the last week. The 4000 level above continues to loom large and offer massive psychological resistance when it comes to the uptrend. This is not to say that we cannot break above there, but it is obviously going to take a significant amount of work to make that happen. By breaking above the 4000 level, we can continue the uptrend and I do believe that we would go looking towards the 4100 level.

To the downside, the 3900 level is a major support level, followed by the 50 day EMA. The 50 day EMA is starting to drift a little bit higher, and I think it will hit the 3900 level rather quickly. This is not to say that the markets cannot go below there, just that the odds certainly favor that we will continue to see buying opportunities on these dips. After all, the 4000 level being a barrier is something that is more psychological than anything else.

Once we get above the 4000 handle, I think that not only do we go to the 4100 level, but that begins to be the next leg higher. When you look at the recent action, you could make out a little bit of an ascending triangle, but all things being equal this is a market that I am simply looking for value to take advantage of. As we start to head into the second quarter, which of course starts during the day on Thursday, there is a good possibility that a lot of new money will flow into the market, as managers rebalance their holdings. With this being the case, I think that Thursday could be rather interesting, but at the end of the day it is a market that has been in an uptrend forever, and I really do not see that changing anytime soon. The S&P 500 should be the beneficiary of the stimulus package coming out the United States as well, and of course money is flowing into US companies as that is where the most profits will be found. Because of this, I believe the S&P 500 will continue to outperform any other indices.