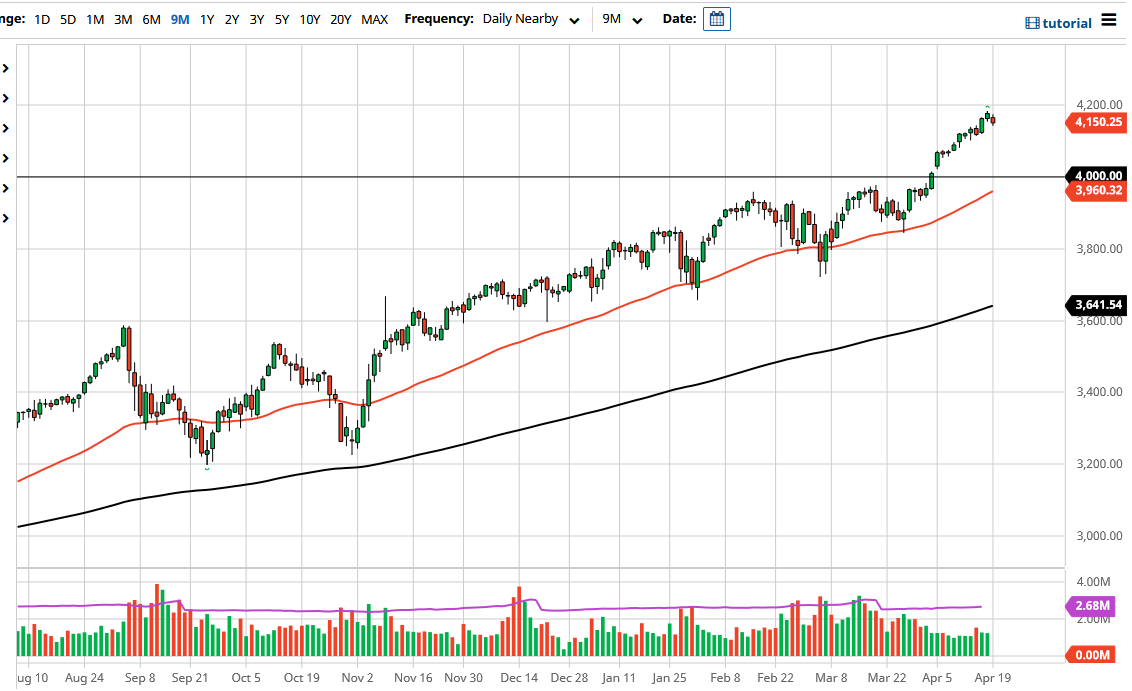

The S&P 500 pulled back a bit during the trading session on Monday to kick off the week on the back foot. That being said, the market is likely to continue to see buyers underneath, as we have been in such a strong uptrend. The candlestick for the trading session was somewhat underwhelming, so I would not read too much into the negativity, only that the market has been a bit overdone.

The 4200 level looks as if it is offering a bit of resistance, but it is going to be psychological more than anything else. Keep in mind that we are still in the midst of earnings season, and that is a great catalyst for markets to continue to move. The 4100 level underneath should be supportive based upon action from just a few days ago, but even if we break down below there, I see plenty of support at lower levels as well. The 4000 level underneath will be a significant support level, based upon the psychology of the big figure and “market memory” due to the fact that it had been resistance. The gap just above there will also be supportive, so that something worth paying attention to.

If we turn around and break above the 4200 level, I suppose it would be a buy signal, but it is going to be difficult to get overly excited about that due to the fact that we are over-extended, and breaking out to a parabolic move certainly would not do any help for buyers. I do prefer seeing a pullback, and I think that pullback will be welcomed by traders, even the ones that are very bullish. The trend has been strong for quite some time, so really at this point there is no way to bet against it. If we broke down below the 50-day EMA, then I might be willing to buy puts, but that is about as negative as I would get with US stocks, due to the fact that the Federal Reserve is doing everything it can to liquefy the markets and continue to inflate asset prices, especially the stock market. The play that I am looking to take advantage of is a dip that offers value.