The S&P 500 fluctuated during the course of the trading session on Wednesday, just as it did on Tuesday. In other words, the market is simply trying to kill time in order to work off the froth from before. The FOMC meeting minutes came and went without much in the way of effect, so having said that I think the market is going to focus on the idea of volatility and yields more than anything else. Furthermore, we also have corporate earnings next week, so that will obviously come into play as well.

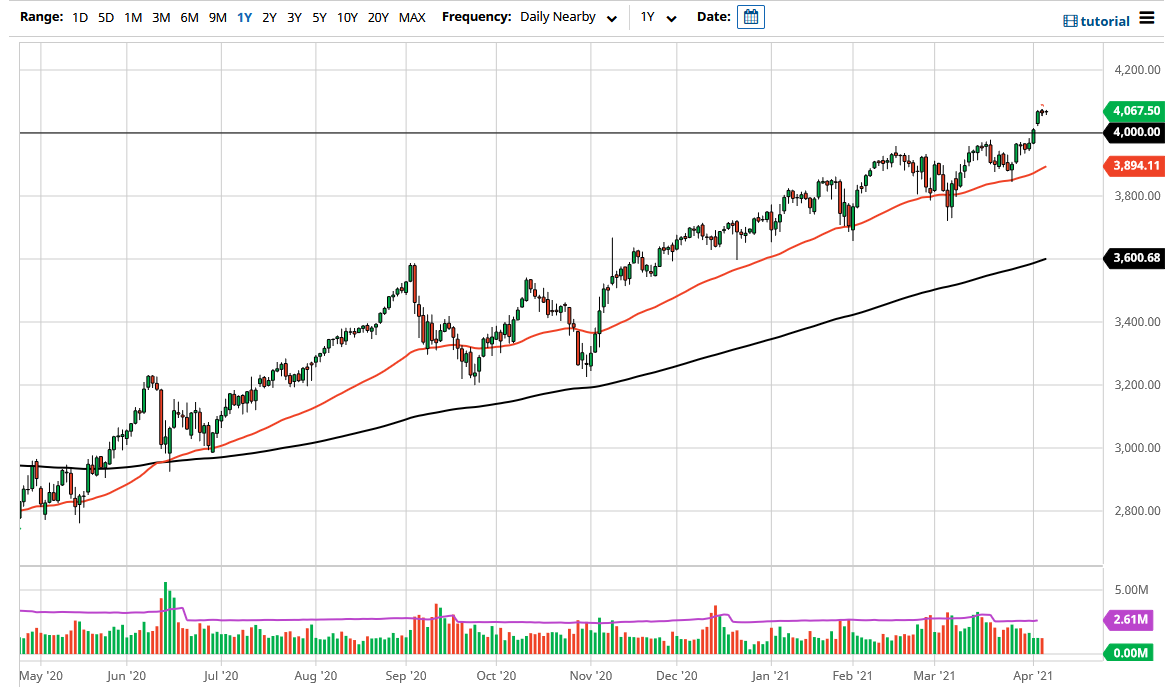

The 4000 level will be significant support, especially considering that the gap sits right in that general vicinity. If we were to break down below the 4000 handle, then I believe that the 3950 level will offer support, followed by the 50-day EMA which sits just below the 3900 level. The 50-day EMA has been rather supportive for quite some time, so you can almost think of it as a bit of a trendline at this point in time.

If we turn around and break out to the upside, which is very possible, then I think the 4100 level would be the first place that we would go looking towards. We clearly do not have much in the way of momentum at the moment, but I do think that eventually we will go looking towards that area. After that, the 4200 level has the making of the next target as well. Looking at this chart, we are clearly in an uptrend, so we should not be looking for shorting opportunities. That being said, if we were to break down below the 3800 level, then you could be a buyer of puts, because at least then you can keep the risk that you put out there minimalized.

I think that the market would more than likely be one of those that people will be looking for value to jump on, because that is what we have seen for the last 13 years. With a track record like that, the probability is going to be that we find a continuation of the overall attitude that we have seen over that timeframe. In other words, people are conditioned to buy dips going forward, especially as yields are so low.