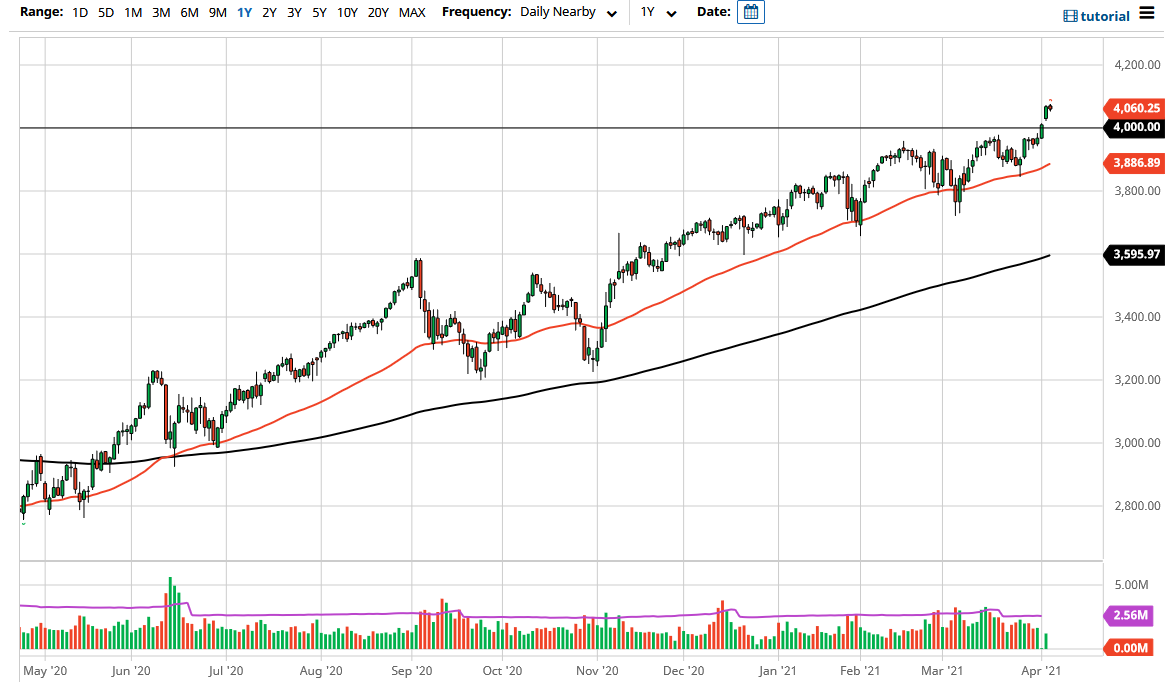

The S&P 500 was rather choppy and quiet during the trading session on Tuesday as traders are struggling around the 4060 handle. This is an area that will attract a certain amount of attention just due to the fact that is the top of the range from the previous session. This market continues to see a lot of hot money flowing in, as people are starting to price in the idea of reopening.

Remember, the United States is far ahead of other countries when it comes to the vaccination efforts, and I do believe that a lot of money is flowing across the world into the S&P 500 as there is the possibility of profits with these companies. Furthermore, we also have earnings season starting next week, so that will come into play as well. The fact that we have a gap above the 4000 level also sets up a potential pullback to test that area for support. I would anticipate that there should be a significant amount of support, so I would look for a supportive daily candlestick in order to get long again. Even if we break down below there, I would not be interested in shorting this market, because I also see support near the 3950 handle, and the 50-day EMA which is currently sitting at the 3886 level.

If we break down below the 3800 level, then I could possibly start buying puts, but at the end of the day I think this is a market that has so much money flowing into it that it is almost impossible to think that we will break down in the short term. I think it would take a massive move in yields to make that happen. As long as yields calm down and stay that way, it is likely that the S&P 500 will go looking towards the 4100 level, followed by the 4200 level. In general, this is a market that is bullish and I continue to look at it as an opportunity to get long yet again. I do think that there are plenty of people out there that have been on the sidelines waiting to get involved in what is an obvious acceleration of a massive uptrend. At this point, loose monetary policy continues to force money into stock markets.