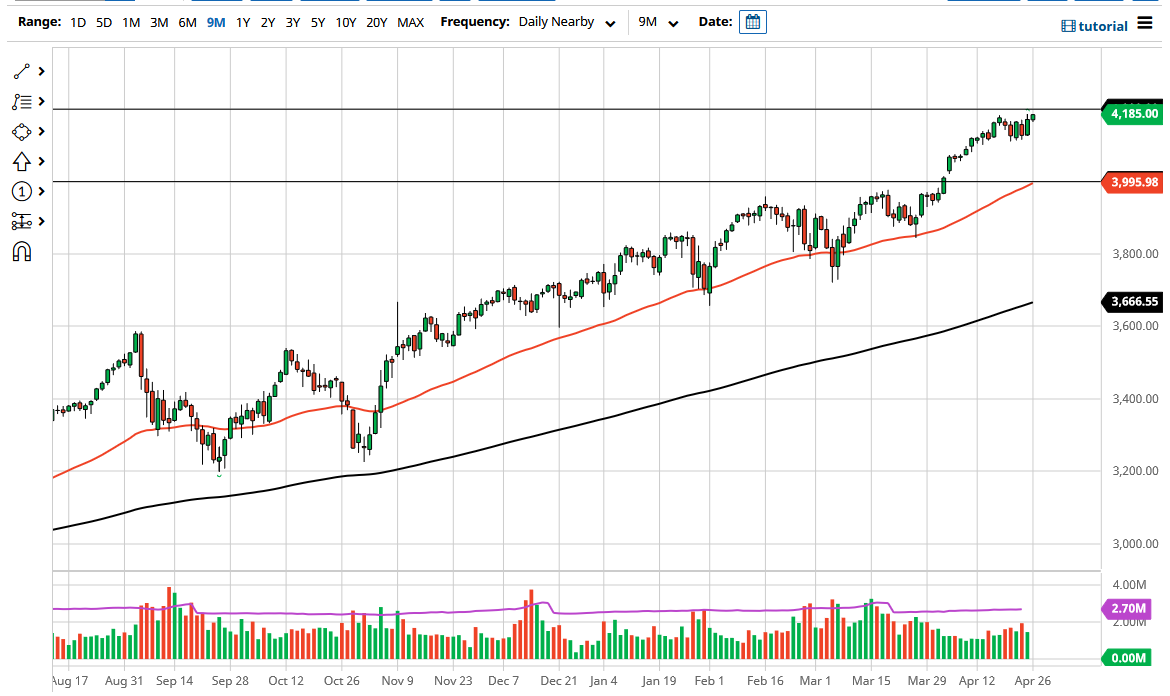

The S&P 500 rallied slightly during the trading session on Monday, as we are trying to get to the 4200 level. The 4200 level is a large, round, psychologically significant figure that will attract a lot of attention, so I think what we are seeing is a situation where the market is going to try to break out.

Keep in mind that there are several huge companies reporting over the next several days, so that should have a lot to do with where we end up over the next couple of weeks. Nonetheless, longer term, we should continue to see bullish pressure, and if we can clear the 4200 level, it is likely that we will then go looking towards the 4400 level over the next several months. The market does tend to move in 200-point increments for whatever reason, but at the end of the day what is more important is that it tends to move higher, as the Federal Reserve will continue to do everything so they can keep the market afloat. We have seen the Federal Reserve throw as much money as necessary since the Great Financial Crisis, and I do not see that changing.

If we do break down from here, I believe that the 4000 level will continue to be massive support, as it is not only a large, round, psychologically significant figure, but it is also where we see the 50-day EMA reaching towards. Furthermore, the gap that sits just above there is an area that a lot of buyers will probably come into as well. With that being said, I believe that the 4000 level will be important. I would not anticipate that this market will break down below there unless something drastic happens.

If we did break down below there, then it is possible that the market would see significant bearish pressure, but at the end of the day it seems very unlikely unless we see some type of huge shift in attitudes globally, perhaps spurred on by more concerned about coronavirus figures. But at this point, the market has digested the idea of Asia slowing down quite well. The United States continues to be leading the charge for reopening, so think the S&P 500 will be somewhat insulated.