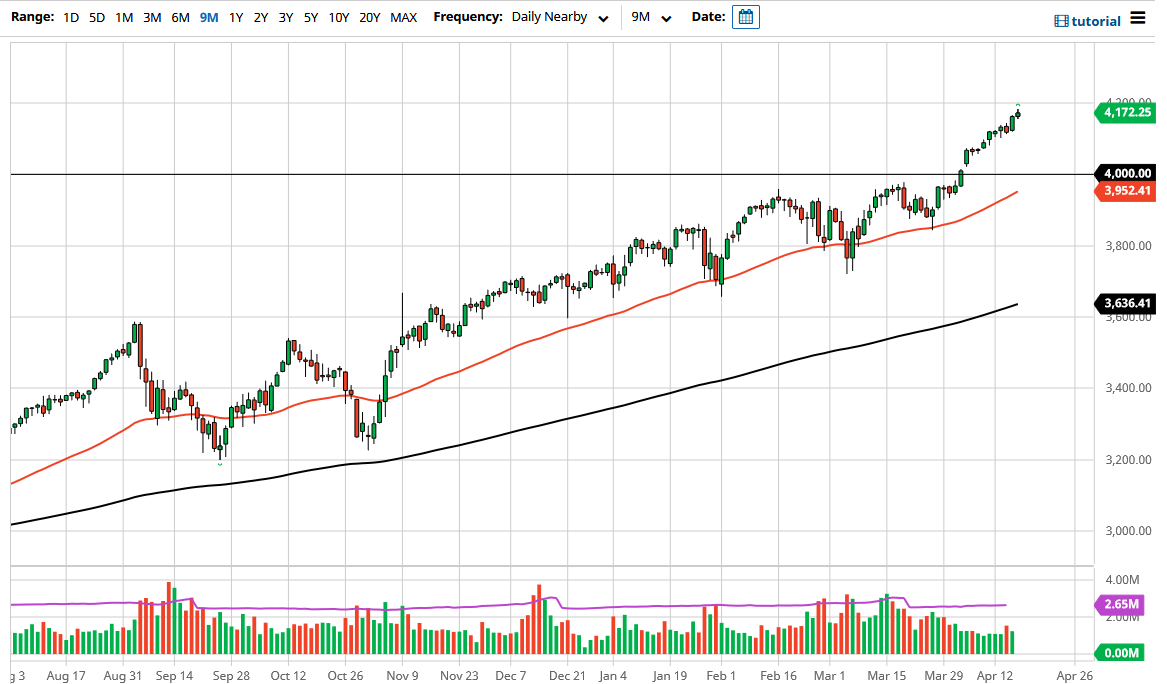

The S&P 500 rallied a bit during the trading session on Friday as traders continue to buy stocks hand over fist. At this point, it looks like we are going to go looking towards the 4200 level, an area that I think continues to show signs of a potential target due to the large, round, psychological significance of it, and the fact that the market is a little over-extended may give us a little bit of profit-taking in that neighborhood.

Nonetheless, we are in an uptrend, and it is almost impossible to imagine a scenario where we should be a seller of this, so I think that given enough time we will see quite a bit of value hunting in this market, especially if we pull back significantly. If we were to break down from here, there is almost certainly going to be a bit of a “floor in the market” near the 4000 handle, as we have a gap there, and the large, round, psychologically significant figure in that area as well. Furthermore, we also have the 50-day EMA reaching towards it, so that should give us yet another reason to think that the market will find value hunters.

It is not until we break down below the 3800 level that I would be concerned about the uptrend, and even then, I think it would be somewhat limited as far as the downside is concerned. I would probably be a buyer of puts underneath the 3900 level though, as perhaps a way to take advantage of the anticipation of significant selling. That way, I can keep from putting a lot of money to work and risk the Federal Reserve stepping in and saying something. After all, that is something that they have done every time the market has fallen rather significantly, going back to at least the Great Financial Crisis, as well as back in '97 during the “Asian Contagion.”

There are some signs of relief when it comes to yields spiking in America, as people are starting to get away from the idea of extreme inflation and looking at this as a stock market that is going to be focusing on earnings for once, but that will be short-lived. At the end of the day, it is all about liquidity, and that is something that we will have plenty of.