The New Zealand dollar initially rallied during the trading session on Thursday but then gave back the gains rather quickly in what were very illiquid conditions. It was Good Friday, and that means that most traders were away from the desk. Furthermore, the non-farm payroll numbers came out of the United States, so that was another reason why a lot of bigger traders would have stepped away from being in the market.

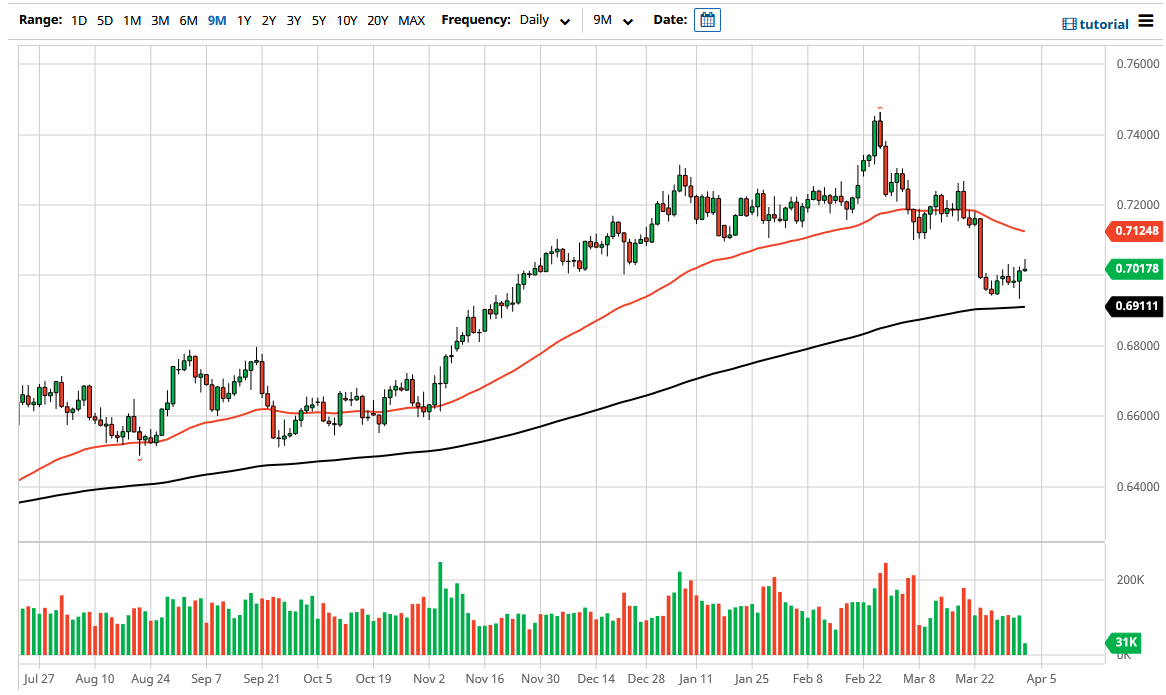

The Kiwi dollar is currently sitting just above the crucial 0.70 level, which in and of itself would probably attract a certain amount of attention. Beyond that, the last several candlesticks have been either neutral, a shooting star, or a hammer. This tells me that we are building up inertia for a bigger move, and that bigger move could have significant implications. The reason I say this is that there are a lot of concerns right now about the yields in America rallying quite drastically.

At this point, the question then becomes whether or not people are focusing on the idea of the global economy continuing to strengthen, or if they are starting to pay close attention to the fact that it is basically America that is going to lead the way. I think you can make an argument for either scenario, so commodity currencies like the Kiwi dollar will be interesting, to say the least.

If we break down below the 200-day EMA, then I think the market has quite a bit of room to run, perhaps reaching down towards the 0.66 handle. On the other hand, if we turn around and break above the top of the shooting star for the session on Friday that could have the market looking towards the 50-day EMA at the 0.7125 level. Either way, I do think that we are trying to build up inertia for a bigger move, but when you look at the most recent price action, you can make an argument for a bearish flag. That is something worth paying attention to, especially if the 10-year yield continues to rise the way it has been as of late. It is also worth noting that the February candlestick for the Australian dollar, which tends to move almost identically to this pair over the longer term, was a massive shooting star.