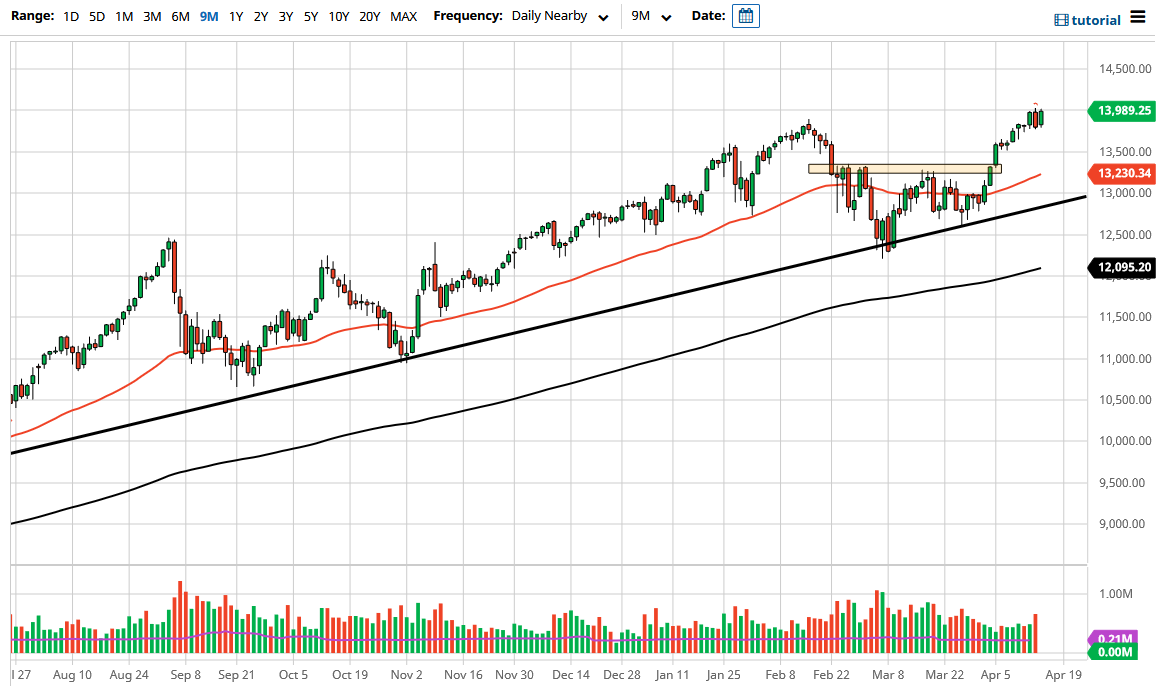

The NASDAQ 100 has rallied a bit during the trading session on Thursday, reaching towards the 14,000 level. The 14,000 level has been resistance previously, and therefore it is likely that we are going to continue to see upward pressure, and I do think it is only a matter of time before we break out to go even higher. At this point in time, I believe that dips will continue to be bought into due to the upward momentum of the market, and of course the fact that the NASDAQ 100 is getting help from the massive amounts of liquidity being pumped into the market.

I do believe that the 13,333 level is going to continue to be a massive “floor” in the market, as it will be remembered for being the previous neckline of the inverted head and shoulder pattern. One thing worth noting is that we have fulfilled the “measured move” from that pattern, so it suggests that we may get a little bit of a pullback in the short term. Nonetheless, that should be a nice buying opportunity for those looking to play the longer-term trend, and I certainly see no reason whatsoever to start shorting this market. We obviously have a lot of bullish pressure underneath, and there are multiple areas where we could see buyers.

The 13,333 level of course is the first major area that I am looking at, and even if we break down below there, I think the 50 day EMA is likely to be supportive, as well as the 13,000 level. The 13,000 level is a large, round, psychologically significant figure and of course we have the uptrend line sitting just underneath there to continue to offer support. If we broke down below that uptrend line, then it is likely that we would continue to see downward pressure, and in that scenario, I would be a buyer of puts, not trying to short this market which is so obviously bullish and of course supported by the Federal Reserve albeit indirectly. The market is a little bit of her stretched, but clearly it is a market that should go to the upside given enough time. All things been equal, the NASDAQ 100 is starting to get more love as the yields in America continue to be somewhat stable which has helped.