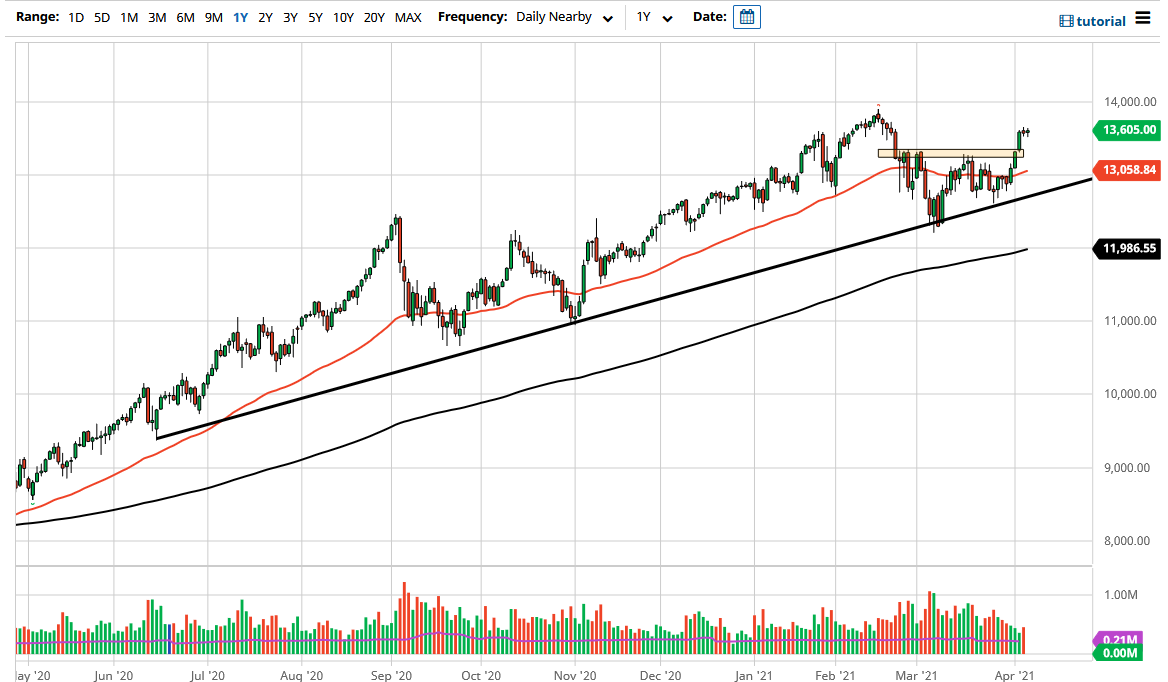

The NASDAQ 100 continues to go back and forth and essentially get nowhere while treading water over the last couple of days. That being said, the market looks as if a pullback could happen, but I think it would be just a buying opportunity on some type of dip. The 13,333 level is an area that previously had been resistance, so I would expect buyers to jump in and get involved in this area if we reach it. Even if we break down below there, I think that it is only a matter of time before we see buyers near the 50-day EMA and the 13,000 level. With all that being said, it is a simple matter of waiting for value to come back into the market before getting long.

On the other hand, we could see the markets go sideways in general, essentially “killing time” before taking off again. Either way, we have some froth the work off, so the market is doing exactly what you would expect it to do in this situation. The market more than likely will find reasons to go higher given enough time, but right now it looks like it simply trying to catch its breath.

Underneath all of that, we also have the uptrend line, so that is something that should be paid close attention to as well. Because of this, I like the idea of looking for buying opportunities based upon pullbacks and have no interest whatsoever in shorting this market. If we did break down below that uptrend line, then I might be convinced to start buying puts, but I would not flat-out short this market.

On the other hand, if we break out to the upside, it is likely that we will go looking towards the 14,000 level again, which is just above where we had the biggest swing higher as of late. I believe that this is a market that will eventually break out to the upside, but the fact that we have gone so parabolic over the last week or so means that we need to relax a bit. That being said, the trend is most certainly to the upside as the “reopening trade” is still in full effect, and as a result, the NASDAQ 100 should rally further over the longer term.