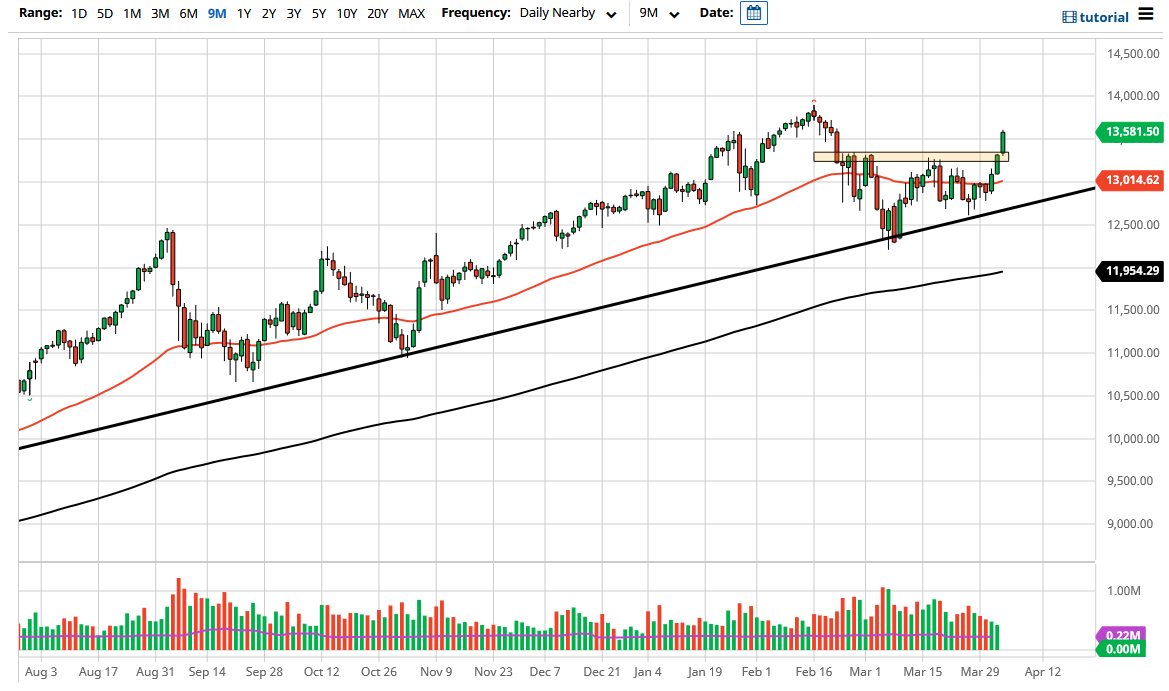

The NASDAQ 100 has broken higher for the trading session on Monday, breaking above the 13,333 level, an area that has been important more than once. I think at this point, the market is likely to see buyers on dips willing to get involved, especially near the 13,333 level which should now offer significant support. What was once resistance becomes support as they say, and that is exactly how I am going to look at this.

The 50 day EMA sits around the 13,000 level, and it is starting to turn higher. I think at this point we will find buyers any time we get back towards the region of congestion, and I do think that we will eventually go looking towards the 14,000 handle. The last three days have been very strong, and you could for the most part call this “three white soldiers”, which is a very bullish candlestick pattern as well.

The NASDAQ 100 has had major issues with the interest rates rising in America, but that seems to be calming down a bit. Besides, it is not as if technology stocks cannot rise in a high-yield environment, just that when yields start spiking the way they have, people start to readjust their portfolios. The technology stocks had been sold off quite drastically over the last couple of months, but they do look like they are trying to recover. After all, now that there are some signs of stabilization in the yield markets, people will start to dip their toes back into these markets. After all, growth had been overvalued at one point, mainly because there is that “risk free rate of return” that treasuries were offering, and of course people were starting to look for value stocks in that scenario.

Looking at pullbacks as an opportunity to get involved “on the cheap” is the way to go going forward, as we have a massive uptrend line underneath the technical barriers to keep this market going higher. If we can break above the 14,000 level, I believe that the NASDAQ 100 will then make a move towards the 14,500 level, followed by the 15,000 level. I have absolutely no interest in trying to short this market, as that has been a great way to lose money for quite some time. If we do break the uptrend line, then I start to look to buy puts.