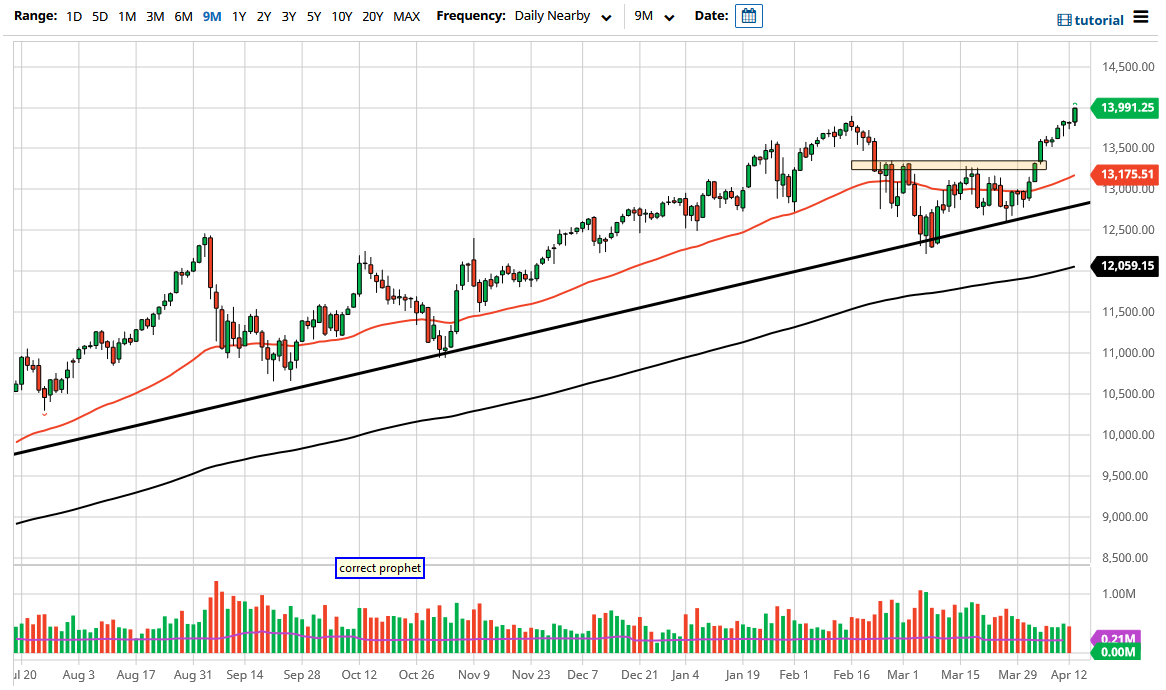

The NASDAQ 100 rallied a bit during the course of the trading session on Tuesday again, as CPI numbers came and went. The market looks as if it is ready to take out the 14,000 level, which is just yet another target that short-term traders have been aiming for. At this point, the narrative that we have seen on Wall Street has simply been a matter of the reopening trade pushing everything higher, so they have been buying everything they can. It seems like that it is more or less a self-fulfilling prophecy.

Regardless of what is true and what is not, the reality is that the market just hit an all-time high again. It continues to do that, and we had recently bounced from a major uptrend line, so clearly the NASDAQ 100 is ready to continue going much higher. We are in the midst of earnings season, so that could be the occasional volatile pullback, but that pullback should be thought of as an opportunity that you can take advantage of.

The fact that we are closing at the top of the candlestick does suggest that we will have a bit of follow-through, so I have no interest in shorting this market. Nonetheless, with central banks and governments around the world manipulating the markets, you simply cannot be short of these markets anyways. For 13 years now, I have been hearing stories about how the whole thing was going to blow up, and it is obvious that it is not going to. That does not mean that we will get a 20% drop at one point or another, but there will be some type of “papering over the cracks” that happens right after that.

One of the hardest lessons for retail traders to learn is that the stock market has absolutely nothing to do with the economy, perhaps due to the fact that most media outlets make it sound as such. The reality is that it is all about liquidity and momentum, both of which are pointing towards higher levels. As long as that is the case, buying dips would be about the only thing that you can do currently. That being said, it is not until we break down below the 13,000 level that I could be convinced to start buying puts.