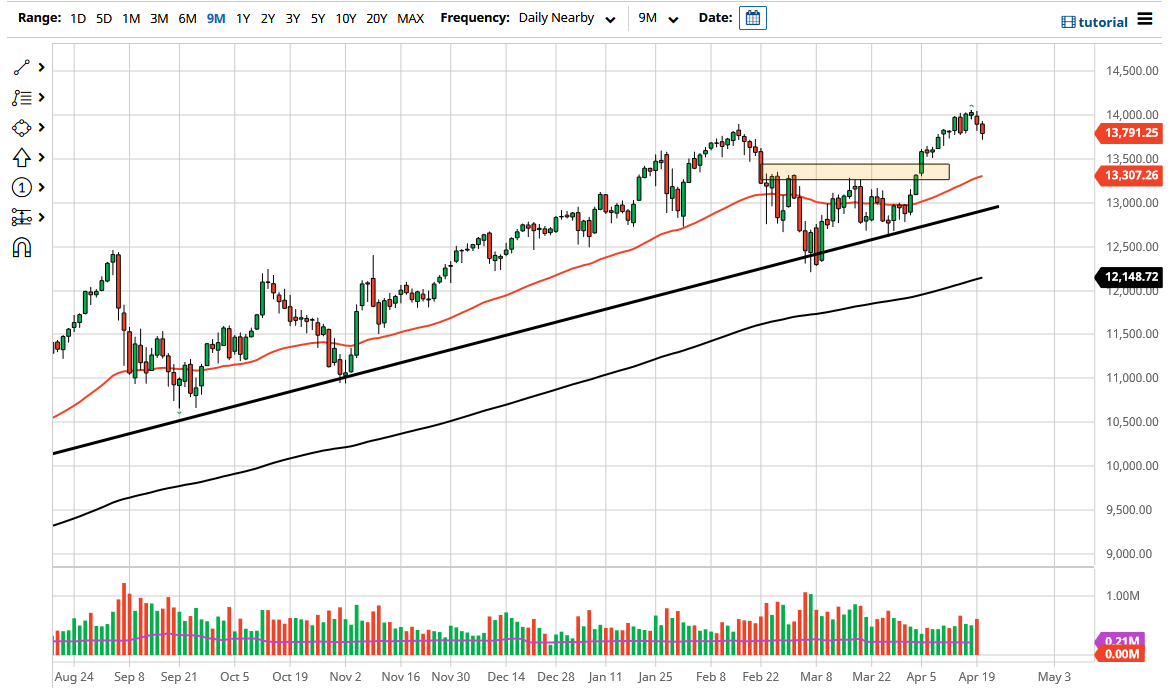

The NASDAQ 100 pulled back a bit during the trading session on Tuesday as the market may have gotten a little bit ahead of itself. The 14,000 level above obviously is massive resistance, but it is worth noting that towards the end of the day, we did see buyers jumping back in to pick up value. After all, the NASDAQ 100 only goes up over the longer term it seems, and as long as the yields in America stay somewhat stable, it is likely that we will see the NASDAQ 100 continue to see buyers.

The markets continue to look very volatile, and I think you have plenty of time to wait for some type of buying opportunity. You do not necessarily need to jump “all in” right away, but you clearly do not want to be a seller of the NASDAQ 100. The current area that the market sits in is somewhat supportive, but then after that we have the 13,333 level, which is the neckline for the inverted head and shoulders that kicked all of this off to begin with. The 50-day EMA sits in that same general vicinity as well, so I think that it gives the area even more credence. After that, then we have the 13,000 level, which coincides nicely with the uptrend line. It is not until we break down through all of that that I would be concerned.

If we were to break down below all of that, then I might be a buyer of puts, but that is about it when it comes to getting aggressively short of this market. The buying of puts allows you to keep the overall risk to a minimum and a “known known.” As far as this market is concerned, I do think that you will find plenty of value hunters, and it does make sense considering that the earnings season is going on, and there should be plenty of people out there looking to put money to work based upon the earnings reports that are coming out daily. The candlestick for the trading session did at least show some type of resiliency at the end of the day, so I think that the downside is still relatively limited in general.