The NASDAQ 100 rallied significantly during the trading session on Thursday, even though the last couple of days have been rather choppy. At this point, the market looks likely to continue to see a lot of bullish pressure, as the NASDAQ 100 has been a huge performer as of late.

The Wall Street traders out there seem to be coming to terms with the idea of higher interest rates that we had a few months ago, and as long as that the rate of change is not too strong, it is very possible that the markets can continue to rally. Furthermore, we need to pay attention to the fact that there is the earnings season kicking off next week, so at this point in time I think that there might be a little bit of hesitation, but clearly next week will be very volatile.

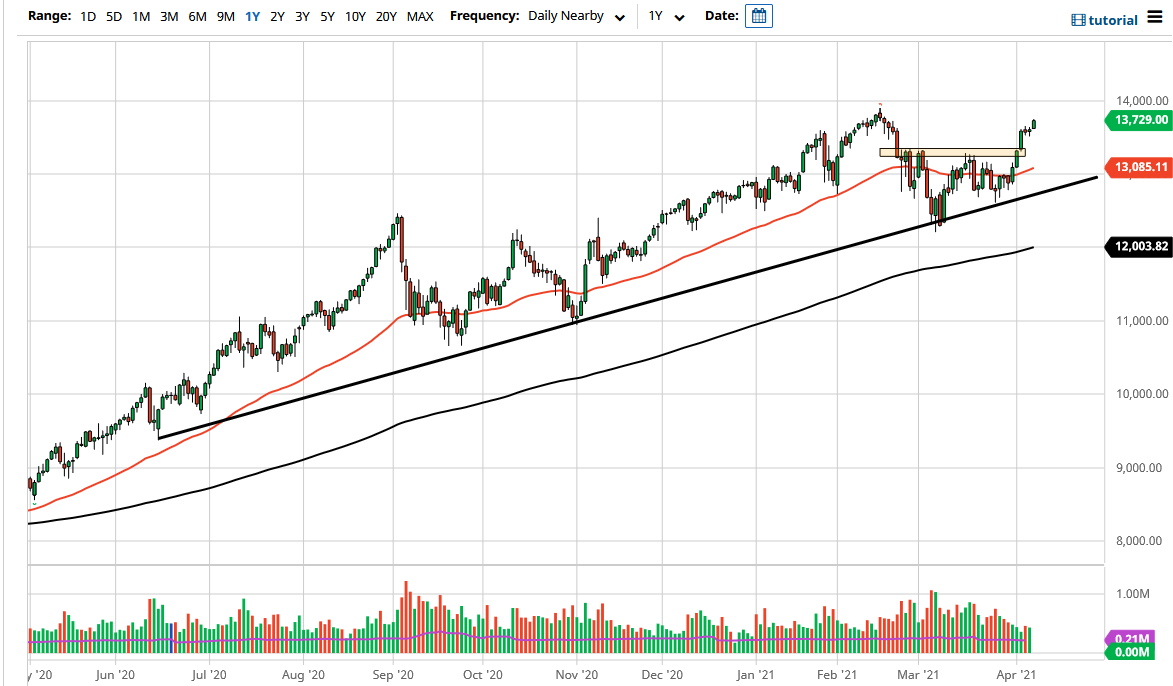

Regardless, it should be noted that this is a market that only goes up over the longer term, as the Federal Reserve is more than willing to step in and protect everyone. Because of this, Wall Street has been conditioned buying these dips and therefore that is what they will do. The 14,000 level above should continue to offer resistance, but if we can break above there then it is likely that the market will continue to go towards the 14,500 level. Breaking above that then opens up the possibility of going much higher.

To the downside, I think the 13,333 level is an area that we need to pay close attention to if we get down to that area, because it should end up being a significant support level as it was significant resistance and the scene of an inverted head and shoulders. After that, we have the 50 day EMA that should offer a significant amount of support, followed finally by the uptrend line underneath that I think is also crucial. With this being the case, I think it is only a matter of time before the buyers get involved and push the NASDAQ 100 to the upside. I have no interest in shorting this market at all, but if we broke down below that uptrend line that might be convinced to start buying puts, because at least that way I know how much I am risking ahead of time.