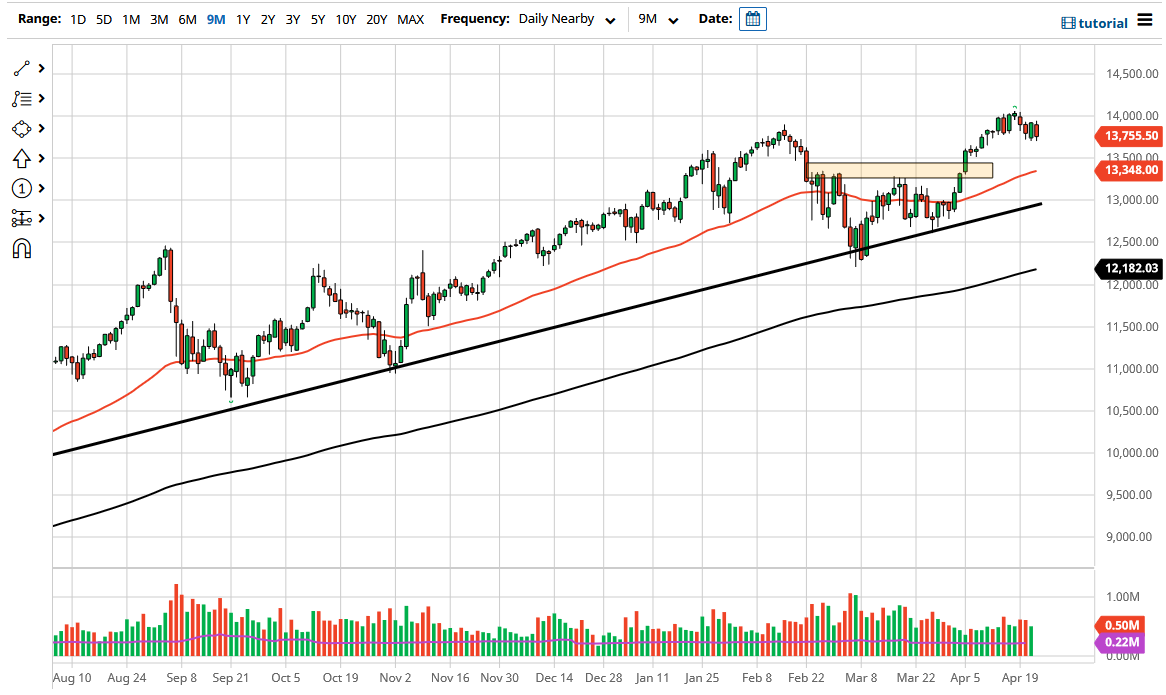

The NASDAQ 100 fell during the course of the trading session on Thursday, reaching down towards the 13,750 level. At this point, it looks like we are going to go sideways in general, but the fact that we have wiped out almost all of the gains from the previous session suggests that we may need to look towards lower support levels to get the market really going to the upside. The 13,333 level underneath was the previous neckline of the inverted head and shoulders that kicked off this move. That could be a major support level, not only do to that neckline but the fact that the 50 day EMA sits in that same area is also something worth paying attention to.

To the upside, the 14,000 level of course is a major resistance barrier, and if we can break above that level, it is likely that the market goes looking towards the 14,500 level. The market is in an uptrend so that is the most important thing that you need to pay attention to and therefore you should be looking for buying opportunities on dips. I would not be a seller of this market, because the US indices are far too manipulated by a central bank liquidity measures. As long as that is going to be the case, it is basically impossible to short anything like an index.

Liquidity measures are the only thing that matters to Wall Street, and therefore they will be paying close attention to central bank policy as per usual. Yes, earnings are nice, but the reality is that as long as Jerome Powell is Federal Reserve chairman, it is very unlikely that the Federal Reserve is going to let this market fall anytime soon. In fact, the uptrend line underneath is probably what you would consider the “floor the market.” That is roughly at the 13,000 level, so it all comes together in the same general vicinity. That being said, look for support of daily candlesticks that you can take advantage of in what has been a clear-cut uptrend that has paid off quite nicely for those who are patient enough to wait for the opportunities. Joe Biden is supposedly bringing out a larger than expected tax program, that may have caused some headaches during the day but at the end of the day, we are still going from the lower left to the upper right.