Gold's bullish attempts hit their limit at $1745, where the price has settled as of this writing. Gold lacks more momentum to take off strongly higher. The strong economic data weakened the commodity's appeal as a safe haven. However, concerns about the sudden rise in coronavirus cases and the slow pace of vaccinations in many countries weakened gold's downward momentum. The price of gold was not affected much by the announcement of the contents of the last meeting of the Federal Reserve.

In the same performance, silver futures rose at $25.247, while copper futures settled at $4.0545.

A report from the Commerce Department showed that the US trade deficit widened to $71.1 billion in February from $67.8 billion in January. Economists had expected the deficit to widen to $70.5 billion from $68.2 billion in the previous month. The widest deficit came as the value of exports decreased by 2.6% to $187.3 billion, while the value of imports decreased by 0.7% to $258.3 billion.

On the other hand, the minutes of the recent monetary policy meeting of the Federal Reserve Board indicated that the US central bank is unlikely to change its extremely loose monetary policy anytime soon. Participants at the March meeting acknowledged the improvement in the medium-term outlook for real GDP growth and employment, but continued to see the uncertainty surrounding these expectations elevated.

The minutes showed that most of the participants still saw the COVID-19 coronavirus pandemic as a significant risk to the economic outlook.

Prior to that, strong data on service sector activity in the Eurozone and the UK raised hopes for a speedy economic recovery. The data showed that the PMI for services in the Eurozone rose from 45.7 to 49.6 in March. This was higher than the initial reading of 48.8. The UK's IHS Markit/CIPS Composite PMI - which measures Britain's mammoth services sector alongside the manufacturing sector - rose to 56.4 in March from 49.6 in February.

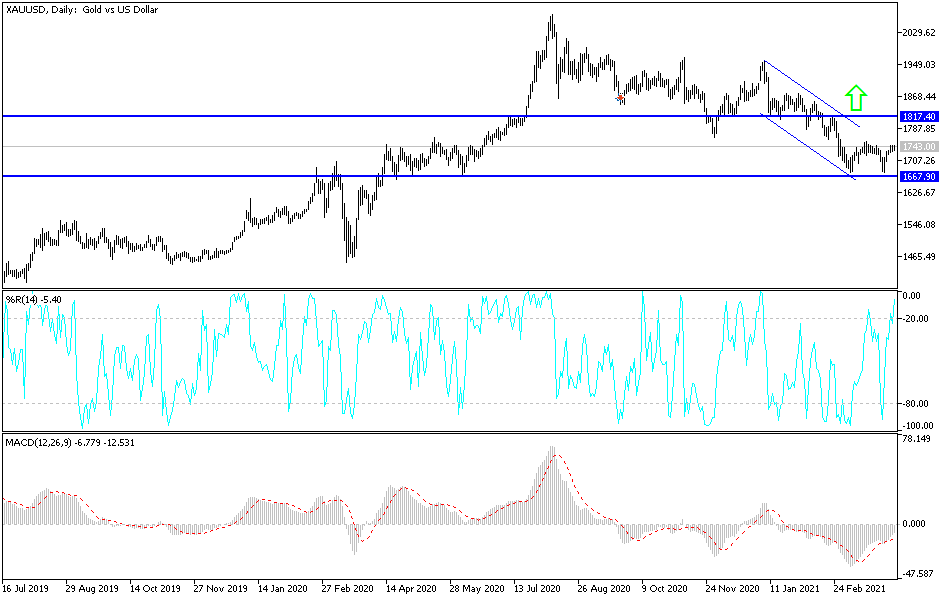

Technical analysis of gold:

Bullish opportunities for the price of gold still exist, but the metal needs more momentum. Without breaching the level of psychological resistance of $1800, there will be no real and significant change to the trend that is currently neutral with a stronger trend towards more losses in the event that the bears target the $1710 support level again. Despite this, I still prefer to buy gold from every downward level. The increase in global infections and the return of restrictions will impede global efforts to revive the global economy and thus increase investor concerns, which is a fertile environment for gold to achieve strong gains, as it is the traditional safe haven at such times.

The most important buying levels for gold are $1722, $1710 and $1677. The price of gold will be affected today by the strength of the dollar, the extent of investor risk appetite, the announcement of the number of weekly jobless claims and the statements of Federal Reserve Chairman Jerome Powell.