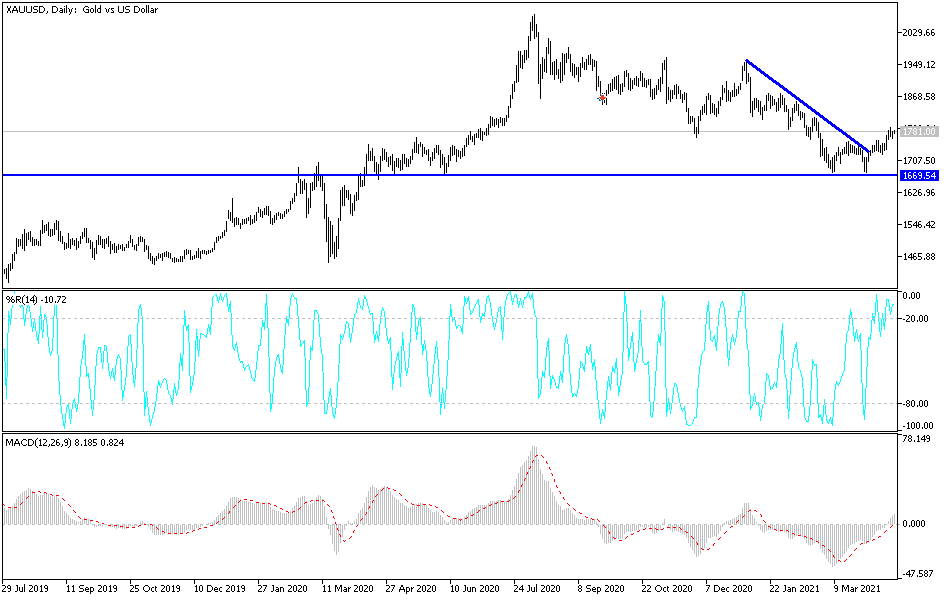

After profit-taking helped bring down the price of gold to the level of $1763, and amid pressures on the dollar, the price of gold bounced higher today to the $1788 resistance. At the beginning of this week's trading, the price of gold jumped to the resistance level of $1791. The bulls are intent on moving to the psychological resistance of $1800, which may increase buying, that may then push gold to the resistance levels of $1822, $1845 and $1875. At the last two levels, the technical indicators will move according to performance on the daily chart towards strong overbought levels.

On the other hand, bullish hopes may collapse if the bears move to the support level of $1710.

Commenting on the performance of the gold price, Adam Cause, President of Libertas Wealth Management Group, said that gold prices have risen since hitting a double bottom on March 30th, referring to the chart pattern that indicates a possible upward reversal in prices. The analyst attributed the rise in gold since late March to the decline of the US dollar during the same period, as well as the decline in interest rates, which have become a "very overbought area" and the "long-term" US stock market, which is "due to decline."

The yield on the 10-year US Treasury note is down to around 1.56%. Lower government debt yields could increase the appetite for precious metals that do not provide a return. Also contributing to the gold's gains was the decline in the US dollar.

Commenting on the price of gold, analysts at the brokerage firm Zaner also wrote in a note Tuesday: “The gold trade was not overly focused on physical demand, as the market instead alternated between interest rates, currency and deflationary issues. In the near term, gold is likely to be vulnerable to the threat of Indian demand and to higher interest rates in the United States, but it benefits from the weakening of the dollar and, perhaps to a lesser extent, deflationary psychology.” Gold is often seen as a hedge against inflation.

Analysts at the company also pointed to news that China's imports of gold had reached their highest level in 14 years. China also announced that it would allow large banks and financial institutions to import large quantities of gold.

The moves in the precious metals market come amid renewed concerns about a resurgence of COVID-19 in parts of the world, including India, as the outbreak has pushed the country to the second-highest infection rate in the world.

Chinese President Xi Jinping has called for a more equitable management of world affairs, and in an implicit rejection of American hegemony, he said that governments should not impose rules on others. Xi's speech at an economic forum comes amid mounting tension with China's neighbors and Washington over its strategic ambitions and demands for a greater role in trade and other policies.

Without mentioning the United States, Xi criticized “unilateralism of individual states” and warned against secession, referring to concerns that tension between the US and China over technology and security would divide industries and markets into separate, less productive areas with incompatible standards. "International affairs should be dealt with by all through consultation," Xi said via a video link of the Boao Forum for Asia on the southern island of Hainan. "The rules established by one or more countries should not be imposed on others."

Xi called for stronger cooperation in research on coronavirus vaccines and steps for making them available to developing countries.

Xi's comments reflected the ruling Communist Party's desire for global influence to match China's position as the second largest economy and frustration at what Party leaders see as US efforts to derail its ambitions. These sentiments are fueled by sanctions imposed by former President Donald Trump that prevent access to US processor chips and other technologies for the Chinese tech giant Huawei and some other companies.

Some of Xi's statements contradicted Beijing's intensification of military activity in the South China Sea and other areas, where its territorial claims contradicted those of Japan, the Philippines, India and other countries. Chinese military spending is the second highest after the United States. Beijing is working to develop ballistic missiles with nuclear capabilities, submarines, stealth fighters and other weapons to expand its military range.

The annual Boao Forum, established in 2001, is modeled after the Davos gathering of business leaders in Switzerland.