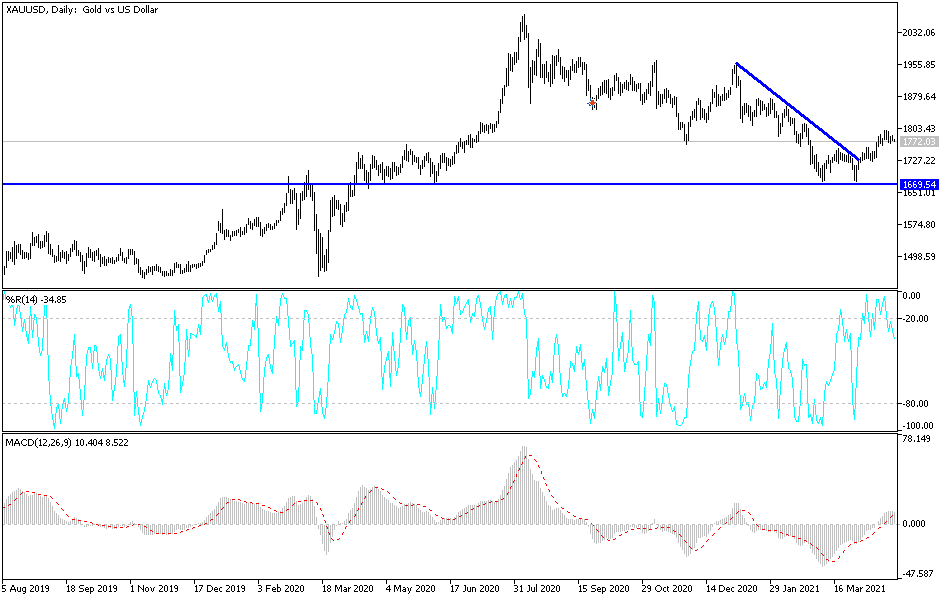

The gold market fluctuated during the trading session on Tuesday again, as we are stuck between the 50-day EMA underneath and the 200-day EMA to the upside. The candlestick ended up being very neutral, and this tells me that the market simply has nowhere to be. That is probably not a good sign for those looking to get bullish on gold, because it looks as if the recovery is starting to lose a little bit of momentum at this point.

Making things worse, the US dollar seems to have gotten a little bit of relief during the trading session, and that can work against the value of gold itself. Furthermore, you should also pay close attention to the yields coming out of the 10-year bond, because if they rally significantly, it will have people looking at the US dollar as very attractive. On the other hand, if we continue to see a lot of concern out there, more money may be flooding into the US dollar than anything else, and that should work against the value of gold.

To the upside, if we were to break above the $1800 level, we would not only clear the most recent resistance, but also the 200-day EMA and a large, round, psychologically significant figure. By closing above there on the daily chart, it opens up the possibility of a move to the $1850 level, and then eventually the $1950 level after that. If that were to happen, one would have to think that the US dollar would get hammered, and suddenly people would be more worried about inflation than anything else, but you should also keep in mind that if the yields in America spike, that works against the value of gold because it means that you can get a “risk-free rate of return” by clipping coupons in the bond market instead of paying for storage over here.

If we did turn around and break down below the $1750 level, then it is likely that we could see a move down to the $1700 level, and possibly even the double bottom underneath. Clearing that could open up a move down to the $1500 level which is the next large, round, psychologically significant figure.