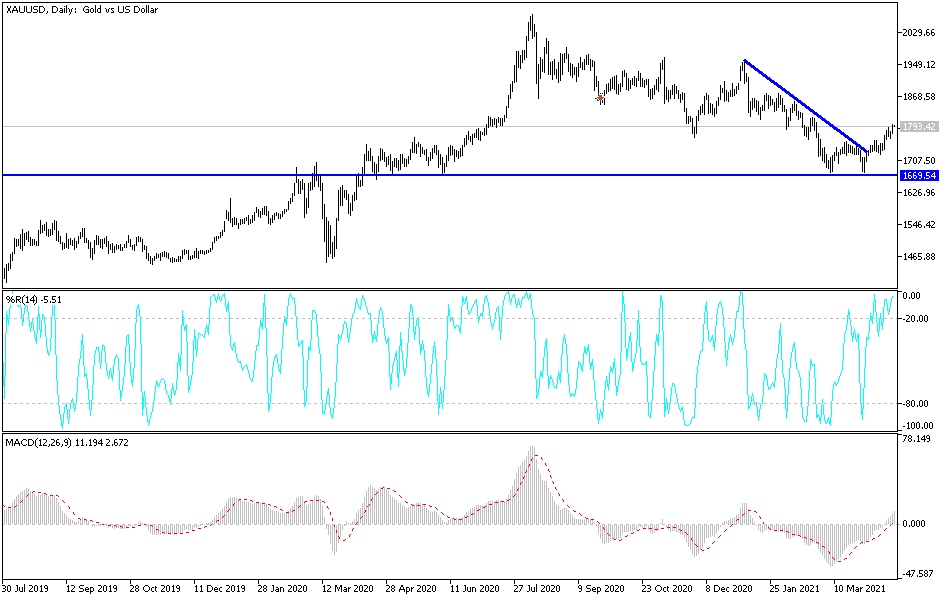

The gold market rallied a bit during the trading session on Wednesday to pierce the 200-day EMA, but did pull back just a bit towards the end of the session. It looks as if the $1800 level is going to continue to be a resistance barrier, not only due to the 200-day EMA, but the fact that we have sold off from there previously. If we can clear that, then I think that gold has much further to go to the upside.

You should keep an eye on the bond markets in America because the yields are starting to calm down again, which is exactly what gold needs in order to thrive. The US dollar falling also helps, so you can somewhat “triangulate” your position that way. Furthermore, you should keep an eye on the fact that we are trying to break out of that little “squeeze” between the 50-day EMA and the 20- day EMA, as I saw that as a consolidation region.

If we did break down below the 50-day EMA underneath, that would be a very negative sign, especially if we ended up breaking down below the lows that were made at the $1725 level. At that point, the market would more than likely go looking towards the double bottom underneath, which would be the gateway to a complete meltdown. Having said that, it does not look like we are going to be doing that anytime soon. Furthermore, you should keep in mind that the candlestick for the trading session is closing fairly close to the top, so that typically means that we will get a bit of follow-through.

On that breakout to the upside, we would be looking at the $1850 level as a target, followed by the $1875 level, and then the $1975 level. Gold will probably do fairly well long term, and it looks as if we have tried to at least make a significant bottom underneath, so I think gold looks much more positive over the next couple of weeks. While I would not “jump all in”, I would perhaps scale into a position and add as it works in my favor. Keep in mind that gold does tend to be very volatile at times, so protect your account accordingly.