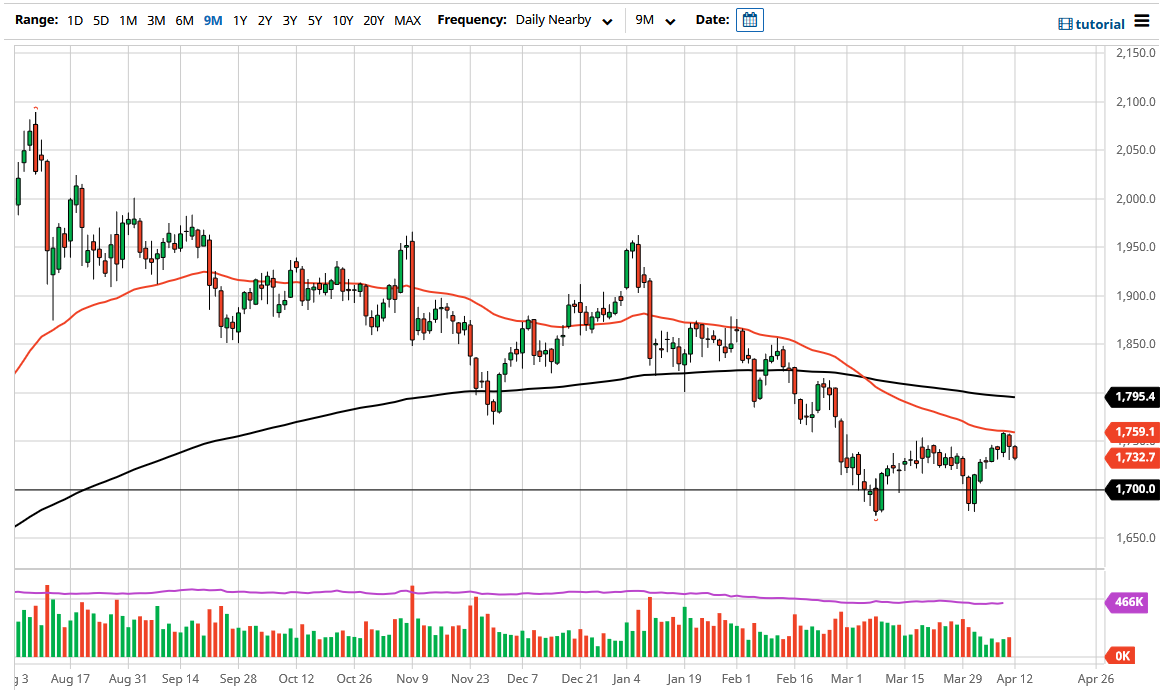

Gold markets have broken down a bit during the trading session on Monday, as we continue to see gold get hammered longer term. At this point in time, the market looks as if it does have a significant amount of support underneath, just below the $1700 level. That is an area that has formed a little bit of a “double bottom” as of late, and as a result a breakdown below that level would be a very negative sign, breaking things down quite drastically.

If we do break down below that level, the market is likely to go looking towards the $1500 level. After that, we could be looking at a move towards the $1300 level. While I do not necessarily think it is going to be easy to make this happen, one thing that could be a major driver of that would be interest rates in America spiking. After all, that has been a huge driver of what is going on in the gold market, due to the fact that the gold markets tend to move in reaction to interest rates and if you can get a “real return” based upon bonds, there is no point in paying for storage fees for gold.

So far, the 50 day EMA has offered significant resistance previous times before, so at this point I think we are simply pulling back from there. However, if we were to break above that 50 day EMA it is likely that we could go looking towards the 200 day EMA which is slightly below the $1800 level. Breaking above that would of course change everything, but right now I do not anticipate seeing that happen. However, if it did then it is likely that the market could go looking towards the $1875 level, possibly even the $1950 level.

In general, this is a market that has been in a downtrend but also tried to form a bit of a basing pattern, so having said that it is likely that we would see a lot of noise in this area. I certainly think the gold markets are going to be very difficult to deal with over the next couple of days, so although it looks like a “back and forth” type of set up, I would keep my position size rather small until we get some type of clarity for a longer-term move.