Pressure is coming back on the pound in general against the rest of the other major currencies, amid increasing concern about the side effects of some international vaccines, which were part of Britain's distinguished vaccination program.

Despite the boring performance of the sterling recently, however, some analysts still believe that the GBP / USD exchange rate has room for recovery in the coming weeks, after corrective selling last week, as it recovered since mid-week trading. The British pound witnessed a tepid recovery after it fell last week to below 1.37, in conjunction with the rise of the euro and the wide losses of the dollar, which was the worst performing currency during the week, especially on Wednesday.

Commenting on the forecast Juan Manuel Herrera, analyst at Scotiabank says, “If there is life in the British pound, it should be able to rally in the next week or so towards mid / above 1.38. We believe that the pound regaining its highest levels at 1.38 / low at 1.39 will shift the direction of stability in the pound into a more bullish expectation towards the peaks of 1.2150 then 1.4175 ”.

The loss of the US dollar came as the US bond market took a set of strong economic numbers and optimistic expectations from the Federal Reserve. Inflation came ahead of expectations this Tuesday as well as on the heels of the March Nonfarm Payrolls report, which showed that the US economy provides nearly 50% more jobs than expected. Although US long-term bond yields remained somewhat far from their March highs while the dollar was deprived of a new opportunity to rise, and although mainly over the past month, strong US data pushed yields to pre-epidemic levels did not benefit the dollar exchange rate.

Lee Hardman, currency analyst at MUFG said, “The recent price action of the US dollar was disappointing as it failed to consolidate on the back of stronger than expected US economic data. This pattern has been repeated again in the wake of the latest US consumer price index report. The Fed’s continued commitment to loose monetary policy remains the main assumption behind our view that it is still too early to expect a sustained appreciation of the US dollar. ”

The inflation data came on the heels of an influential survey indicator indicating that service sector activity in the United States reached an all-time high in March, while there is a stronger recovery in the labor market and the economy is still making its way towards recovery according to repeated statements by the president of the Federal Reserve, Jerome Powell.

Powell told CBS Newshour at the start of trading this week that the US labor market could create or recover from the Corona virus up to a million jobs in some months during the coming quarters. "We feel as though we are in a place where the economy is about to start growing more quickly and job creation is happening much faster," he added, but we emphasized that the Fed would not be afraid of the horrific changes to its policies in remarks that have since been echoed by other members of the Market Committee.

This is an incentive for investors to sell the dollar and is likely to grow larger over time as the economy recovers, which supports the pound. The Fed's stance results from a new policy strategy that makes it look to lift inflation above the 2% target for an indefinite period, in a bearish development for the dollar as it ensures that higher rates will ultimately devour little of the yield, provided by US government bonds.

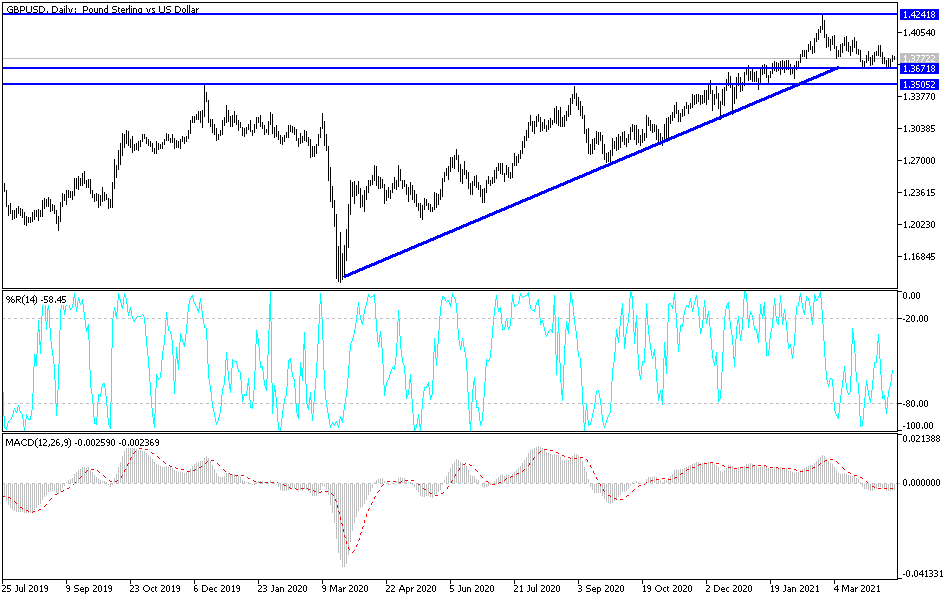

Technical analysis of the pair: Neutrality still dominates the performance of the currency pair, the British pound against the dollar, GBP / USD, and the bulls' control will be strengthened. The current bearish fears will end by moving towards the resistance levels 1.3910 and 1.4025, respectively, according to the performance on the daily timeframe chart. On the downside, a breach of the latest support 1.3670 will increase the current bears' control over the performance and thus push the currency pair to stronger support levels. I still prefer to buy the currency pair from every downside.

Today, the sterling dollar currency pair is not anticipating any important and influential British economic data. Therefore, the focus will be on the announcement of retail sales, the number of weekly US jobless claims, the reading of the Philadelphia Industrial Index and the industrial production rate in the United States.