Despite the risk appetite that is dampening the GBP/USD’s performance, the pair is moving timidly to the upside, with gains that just affected the 1.3951 resistance level as of this writing. Despite the British progress in vaccinations and easing of restrictions, the pound suffered a setback from a new danger looming on the horizon, namely the increase in political suspicion associated with the imminent Scottish elections and that any meaningful gains for the pound will not be likely before the result of the vote. Scotland will vote to elect the next Holyrood Parliament on May 6, and political commentators say the strong result of the pro-independence parties will increase pressure on the UK government to grant another independence referendum.

Commenting on this, Paul Robson, head of foreign exchange strategy for the Group of Ten at NatWest Markets, says his team has reduced exposure to the pound in anticipation of the vote, and any subsequent outcome could raise questions about the UK's long-term viability. “It is about event risk and the long-term positioning of the pound sterling,” he said in a recently published strategy note.

Polls show that Nicola Sturgeon's pro-referendum Scottish National Party is on track to win the vote, but recently the question of whether the party can secure a majority has increased. The SNP's high score in the polls appears to have occurred at the end of 2020, but has since faded as the Conservative and Labor Parties have seen their share of the polls increase.

If the Scottish National Party wins a majority, Sturgeon says this is an implicit endorsement of her party's desire to secure a second referendum. Berenberg Bank analysts also say this is an "important election". In a recent client briefing, Bierenberg said that the Scottish parliamentary elections could lead to a party majority in favor of Scottish independence. Not only is the SNP supporting a second referendum, but so are the ALBA and the Greens.

Hence, any combination of outcomes could lead to a pro-independence majority. If analysts are right, and concerns about the Scottish vote are weighing on the British pound, confidence is likely to revert to 2021 only if pro-independence parties are denied a clear mandate. The vote will come as the sterling’s strong start to the year was diminished by losses in April, with the pound to euro exchange rate falling from a peak of 1.18 on April 05 to 1.1519 in just days before the Scottish vote. The pound sterling also retreated to the level of 1.3668, after its gains to 1.4240 at the beginning of trading in 2021.

HSBC has become the latest UK bank to expect the Bank of England to begin tightening monetary conditions in the UK at its policy meeting in May, a move that could continue to support valuations of the pound. HSBC economists tell clients in a new research note that the Bank of England (BoE) will announce that it will start scaling back its quantitative easing program by slowing its acquisition of bonds from the open market.

So says Elizabeth Martins, chief economist at HSBC: "The May meeting may be the time when the MPC begins to gradually cut back on asset purchases." HSBC expects the Bank of England to announce a cut in the pace of purchases of the quantitative easing program, while raising its forecast for growth and lowering its near-term inflation forecast.

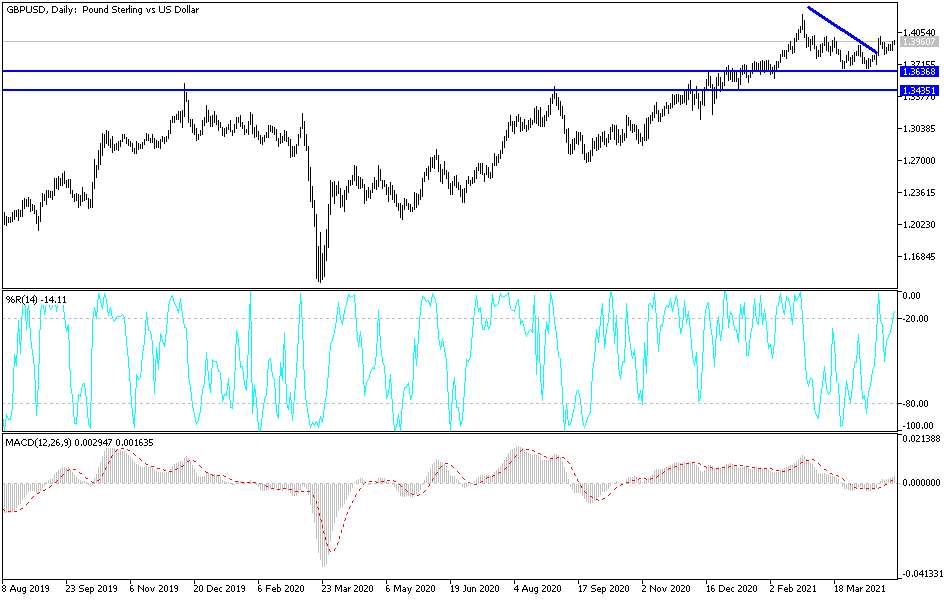

Technical analysis of the pair:

The bulls' control over the performance of GBP/USD will increase by moving above the 1.4000 psychological resistance, which is crucial for increasing buying positions. The catalysts for the pair’s gains, namely the vaccinations and easing of restrictions, will ensure that the pair remains steadfast in the coming days. The bears will regain control over the performance by moving the currency pair towards the 1.3720 support level, according to the performance shown on the daily chart. I would still prefer buying the GBP/USD currency pair from every dip.

There is no significant British economic data today, and the main focus will be on the US side, with the announcement of the GDP growth rate, weekly US jobless claims and pending home sales.