The GBP/USD pair is still attempting to rebound higher, but sufficient momentum is lacking. The pair is still stable around the 1.3850 level, similar to its performance last week, which also witnessed a retreat to the 1.3705 support level. Improved US economic performance, along with more stimulus plans to revive the economy in the face of the pandemic's effects, was a catalyst for the dollar in its recent gains against all other major currencies. At the same time, the pound's gains suffered a setback from some anxiety over the supply of more vaccines, along with some serious side effects of some vaccines, which makes Britain lose the advantage of global progress in this path.

Currently, Britain is planning to test a series of measures including "coronavirus case certificates" in the coming weeks to see if they can allow people to safely return to mass gatherings in sports arenas, nightclubs and concerts. People attending a range of events this month and in May will need to get tested before and after that. The trials will also collect evidence about how ventilation and different approaches to social distancing can enable large events to move forward.

Officials are also developing plans to test COVID-19 passports that are expected to show whether a person has received a vaccine, recently tested negative for the virus, or had some immunity due to contracting the coronavirus in the previous six months.

The issue of pollen passports has been the subject of heated debate around the world, including the United States and Israel. The question is to what extent governments, employers, and other places have a right to know about a person's virus status. Many disagree about the right balance between a person's right to medical privacy and the collective right of people in groups not to become seriously ill from others.

Some critics also say that these vaccine passports will enable discrimination against poorer countries that do not have access to vaccines.

Despite Britain's success on the vaccination front, it still has the highest reported death toll from COVID-19 in Europe at around 127,000 deaths. Infections have decreased dramatically in Britain. On Sunday, the government reported 2,297 new confirmed daily infections and 10 additional deaths. That compares to about 70,000 new cases per day and up to 1,800 daily deaths from COVID-19 in January. The latest numbers are likely to be lower than expected due to the delay in reporting during the Easter holidays.

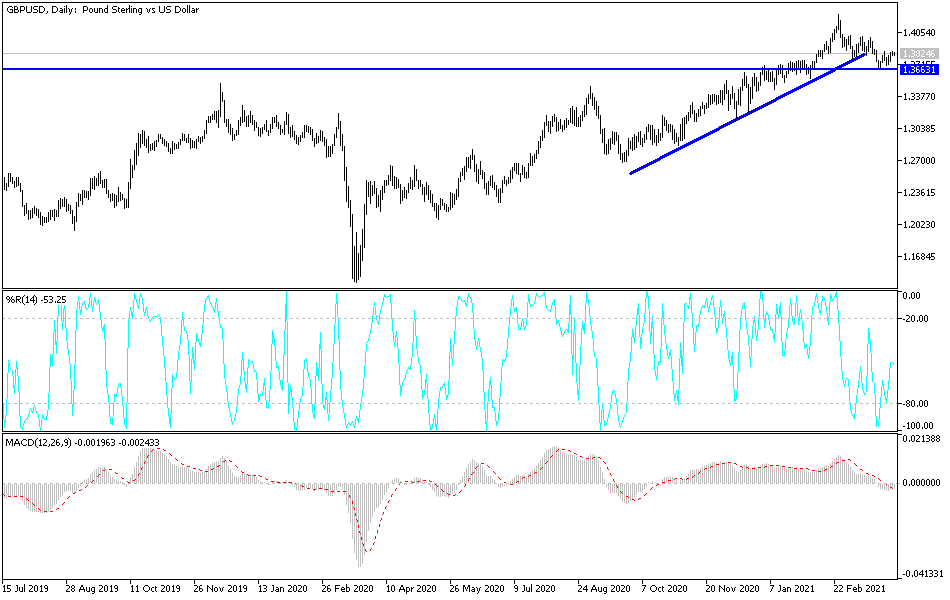

Technical analysis of the pair:

On the daily chart, the GBP/USD pair is still moving in a neutral position and may be more inclined to the downside if it stabilizes below the support level of 1.3800, which may increase the control of the bears to move towards support levels. The strongest and closest support levels are currently 1.3745, 1.3660 and 1.3580. Still, I would prefer to buy the pair on every downside. On the upside, the psychological peak of 1.4000 is still the most important for the return of bullish control. I would expect quiet moves in very tight ranges given today's holiday.

The pair is only waiting for investor sentiment to respond to the events and the results of the recent economic data, in addition to the announcement of the ISM PMI reading for services and US factory orders.