During yesterday's session, despite thedollar's strength, the GBP/USD pair bounced back to 1.3811 before settling around 1.3780 at the beginning of Thursday's trading session. This was the first trading session in April, which is the traditional timing of the pound's gains in the Forex market. The strength of the dollar was a good and natural reason for the currency pair to retreat to the support level of 1.3670 during trading this important week. The UK's progress in the pace of vaccinations and the gradual easing of restrictions will be factors for the expected upward rebound.

The optimism of sterling has recently been boosted. What has been announced is that the blow to the UK economy in 2021 from the COVID-19 crisis appears to be smaller than expected, and the large increase in savings by UK households means a strong recovery in growth in the coming months, even if the size of this consolidation is highly contested by economists. According to official figures, the size of the UK economy, as measured by the gross domestic product (GDP), has shrunk by 7.3% in the last quarter of 2020 compared to the same time of the previous year, which is less than expectations of -7.8%. Therefore, economists will have to raise growth projections for 2021.

The British economy experienced an actual growth of 1.3% in the fourth quarter compared to the third quarter of 2020, which is greater than the 1.0% the market had expected. Taking into account 2020 as a whole, the Office for National Statistics says the economy has contracted by 9.8%, which is slightly lower than the previous estimate of 9.90%. Commenting on the numbers, Ruth Gregory, Chief Economist in the United Kingdom at Capital Economics, said: “The upward revision of GDP in the second half of 2020 means that the economy does not have much to recover from the COVID-19 crisis. The high savings rate in the fourth quarter leaves much room for a rapid recovery in 2021, both driven and financed by consumers.”

The big drop in the second quarter of 2020 - when the COVID-19 scare was at its peak - was actually deeper than previously expected, with the Office for National Statistics saying that the drop in GDP in the second quarter from April to June is estimated at 19.5%, a downward revision of 0.5%.

Looking ahead, the components of a strong economic recovery in the coming months are likely to be driven by the spending of the pent-up savings that British households have accumulated during the lockdown.

The household savings rate increased to 16.1% in the fourth quarter, up from a revised 14.3% in the third quarter 2020.

But the positive British economic data was offset by better-than-expected results from the US economic data led by ADP, which gave a bright picture of the US labor market figures, the details of which will be officially announced on Friday. This is in addition to the announcement by the US administration of plans to stimulate the US economy in the face of the effects of the pandemic at the same time that the United States intends to top the list of countries that vaccinate its people.

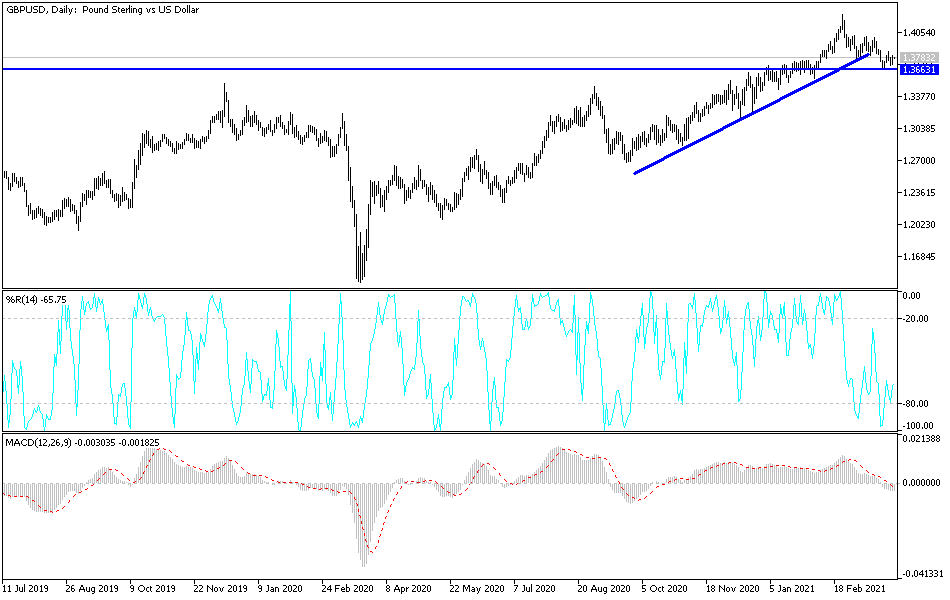

Technical analysis of the pair:

I still see an opportunity for an upward rebound in the GBP/USD currency pair, and it is best to buy from each descending level, the closest of which are 1.3690, 1.3580 and 1.3500. The bulls will not get stronger control over the performance without moving the currency pair towards the 1.4000 psychological resistance level again. On the daily chart there is a neutral performance for the currency pair in pending bullish position.

The British pound has long tended to outperform most other major currencies in April in particular, according to research from Nomura and Bank of America Global Research, and if this pattern is repeated this year, it could bring the pound back to the top of the currency leaderboard for 2021. Analysis shows that the British pound traditionally strengthened against all G10 currencies in April with the exception of the Australian dollar, with the pound sterling appreciating against the dollar at a rate of close to 2% in recent years.

They also showed that April is always a bleak month for the dollar in general, and that May is better for the dollar.

From Britain, the Manufacturing PMI reading will be announced. From the United States, the number of weekly jobless claims, ISM Manufacturing PMI and Construction Spending Index will be announced.