The GBP/USD pair's bullish performance continues as bulls target the 1.4000 psychological resistance, to further momentum in the Forex pair. The pair is on the cusp of the 1.3900 resistance, awaiting anything new. All in all, April is usually a strong month for the British pound from a seasonal perspective, but April 2021 disappointed those looking for a stronger UK currency. Whereas, it appears that the strong supportive winds that lifted the British pound in the first three months of the year have lost ground in recent weeks, leading to some "center squaring" in the market.

Nevertheless, the UK is expected to see a strong economic recovery in the coming weeks and months, leading a number of analysts to believe that the British pound should remain supported through any weaknesses. “In many ways, the first quarter was the nearly perfect backdrop for the sterling’s outperformance,” says Kamal Sharma, a Forex strategist at Bank of America, adding that contributions to the outperformance included the “Brexit deal release valve”, strong periodic tailwinds, rising global rates and perhaps most importantly, the UK vaccine rollout progress.

New research from Bank of America finds that both the survey and flow evidence show that UK assets were under-invested at the start of the year, but that the UK has attracted significant portfolio flows over recent weeks and months. Accordingly, Bank of America analysts say that on the back of the global abundance of liquidity and strong cyclical tailwinds, the British pound should remain supported throughout the rest of the year in particular against the likes of the Swiss franc and the Japanese yen.

The British pound was weak durinng last week's trading, even with the announcement of a wave of strong economic data in the United Kingdom, and the British economic calendar is calm in the coming days, although the brighter global outlook is likely to be supported by strong US GDP data, which may lead to losses from the countercyclical dollar.

This will be before the Fed provides its ninth iteration of its bearish policy forecast for the dollar.

The British pound has benefited from the easing of Brexit tensions in the wake of the trade deal struck between the European Union and the United Kingdom at the end of 2020, and sentiment over UK assets has also helped launch a rapid vaccination in the country, leading economists to argue that the UK will reap the rewards.

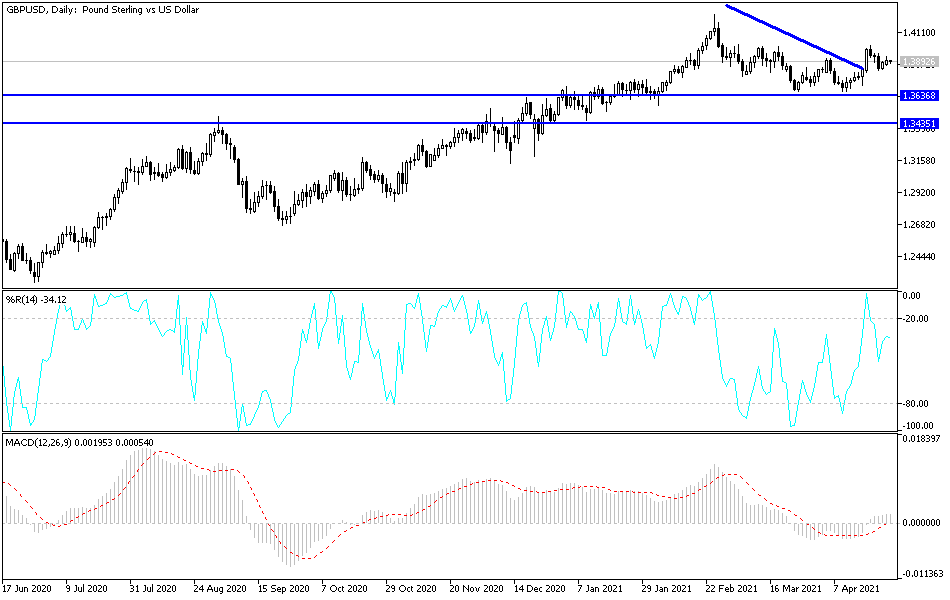

Technical analysis of the pair:

On the daily chart, the GBP/USD is in a relatively neutral area, and stronger expectations indicate the possibility of completing the upward correction, especially if investors react positively to Britain's easing of restrictions and the results of important US economic data. The currency pair may remain in a limited range until the US Federal Reserve announces its monetary policy decisions tomorrow. Currently, bulls must push the currency pair to settle above the 1.4000 psychological resistance in order to increase buying and thus move towards stronger highs, the closest of which are 1.4065, 1.4125 and 1.4245.

The threat to bullish expectations will be if the bears push below the support level of 1.3720. In general, I still prefer to buy the currency pair from every downside.

There is no significant UK economic data today. Focus will be on the release of the US Consumer Confidence Index.