During an upward correction phase, the GBP/USD pair tried to move during last week’s trading. However, the gains of the bounce did not exceed the 1.4008 psychological resistance and, by the end of last week’s trading, it collapsed to the 1.3830 support level before starting the week’s trading, stabilizing around 1.3875. The performance of the British pound was weak last week, even with the announcement of better-than-expected economic data in the United Kingdom. This week, the focus will be on US economic data, the most prominent of which is the US Federal Reserve policy announcement. In general, the brighter global outlook is likely to be supported by strong US GDP data, which may impose losses from the countercyclical dollar.

That will be before the Fed provides its ninth iteration of its bearish policy forecast for the dollar. Commenting on this, Zach Pandel, Co-President of Global Foreign Exchange Strategy at Goldman Sachs, said, “From now on, the US currency may face tighter competition. Once the vaccination campaigns in major markets progress further, we expect the currency markets to re-focus on the structural negatives of the dollar.”

The trillions that Washington spent this year will likely mean that the United States grew strongly in the last quarter. Although the Fed has pledged as part of its strategy to target average inflation to keep interest rates near zero for some time now, it is unlikely to help the dollar this week.

The UK's public sector spending deficit in 2020/21 reached a total of £303 billion, according to new data released by the Office for National Statistics last Friday, which amounts to 14.5% of GDP and a new record after World War II. However, the number is below OBR's set expectations of £327 billion, leading some economists to argue that the country's financial situation should stabilize and recover faster than many expect.

Accordingly, the Office for National Statistics says that the additional financing required by government support plans for the coronavirus, along with declining cash revenues and declining GDP, have all helped push public sector net debt as a percentage of GDP to levels last seen in the early 1960s. Tax income decreased by 34 billion pounds from the previous year while spending increased by 203 billion pounds.

Of that amount, £78 billion was spent on the Leave Scheme to support jobs and wages.

The Office for National Statistics in Britain said that interest payments on central government debt were 38.8 billion pounds in fiscal year March 2021, 9.3 billion pounds less than in fiscal year March 2020. The situation must stabilize if growth accelerates in the coming months.

Accordingly, Capital Economics expects an estimated direct government subsidy of £93 billion (4.1% of GDP) in 2021/22 and should keep public borrowing high at around £230 billion (10% of GDP) in the 2021/22 year.

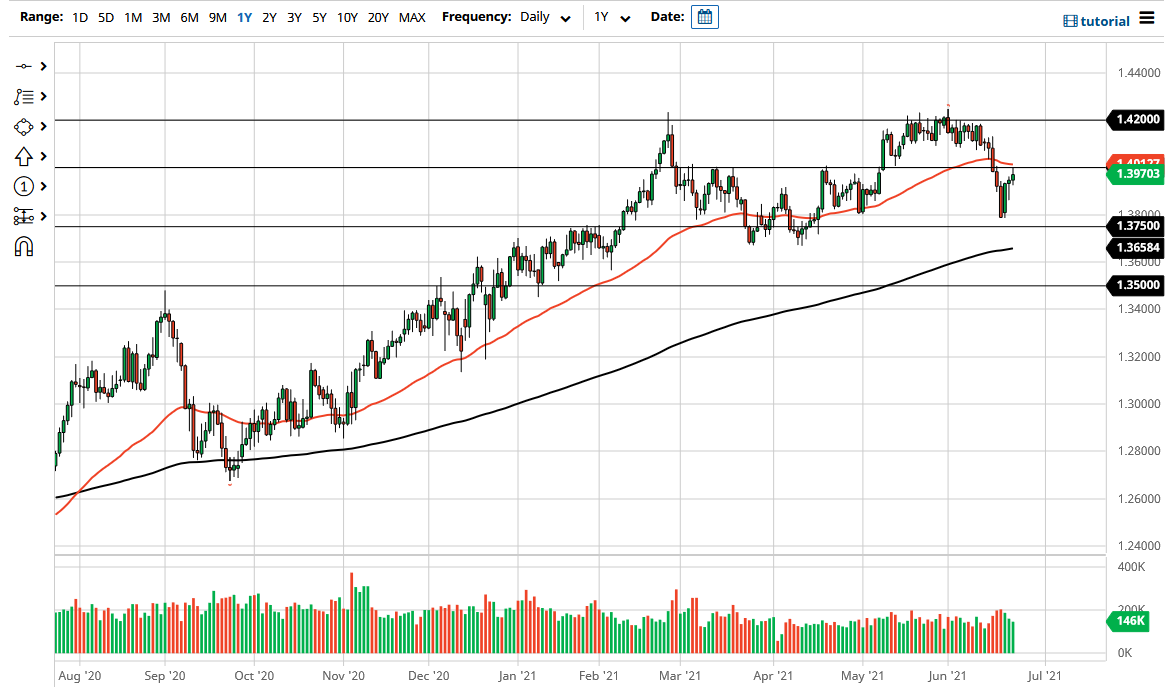

Technical analysis of the pair:

On the daily chart, the bulls still need to break through the 1.4000 psychological resistance to complete the recent upward correction, and then move towards higher and closer peaks after that at 1.4075, 1.4155 and 1.4300. Failed attempts to rebound to the upside will strengthen recent bearish attempts, especially if the currency pair moves below the support level of 1.3745. In general, I still prefer to buy the currency pair from every downward level.

There are no important UK economic data today. From the United States, the durable goods orders number will be announced, a statement concerning spending ratios and US consumer confidence.