Friday's trading session saw upward correction attempts by the GBP/USD pair as it rose from the 1.3715 support level to the 1.3840 resistance, where it closed the week's trading. A number of analysts point out that both the pound and the US dollar have benefited from a rapid launch of vaccinations in the first three months of the year, providing the possibility of a sustainable opening of their economies. However, this vaccination feature now appears to have completed its course and is evident in the prices of the two currencies.

Commenting on this, Osborne, a Scotiabank Forex strategist, says: “It seems that the sterling gains on the back of vaccines have been exhausted and may have temporarily diminished as the UK faced a hurdle from supply delays, which means that countries that were considered underdeveloped (such as Germany and Canada) are progressing. Now vaccines are at the same daily rate as the UK, albeit with a much smaller proportion of the population being vaccinated.” Nevertheless, Scotiabank analyst says the probability of strong data covering the April period “should see the UK's vaccine advantage reflected in concrete macroeconomic terms that are likely to lift the pound sterling”.

He adds that the British currency is also vulnerable to consolidation in the run-up to the BoE meeting in early May as the bearish expectations mount. The term “tapering off” refers to the expectation that the bank will begin resolving the quantitative easing program in response to the recovery of the economy. The basic rule in Forex trading is that lowering and raising interest rates leads to an increase in the value of the currency.

Expectations have shown that a strong economic recovery through 2021 will allow the bank to back away from introducing ultra-supportive monetary conditions.

Investor sentiment was boosted by a flurry of encouraging reports on employment, consumer confidence and spending, pointing to the growth of the US economy. COVID-19 vaccines and massive support from the US government and the Federal Reserve are fueling expectations of strong corporate earnings growth as more companies reopen after being forced to close or operate on a limited basis due to the pandemic. The latest round of government stimulus has helped boost US retail sales, and investors should now consider other proposals in Washington, which include infrastructure investments and potential tax changes.

Investors also continue to focus on the global economic recovery. The Chinese economy grew at a staggering annual rate of 18.3% in the first quarter of the year, the government said last Friday. The second largest economy in the world contracted, as it did in most countries of the world, during the first months of the epidemic.

The US Commerce Department said that home construction in the United States rebounded strongly in March to the fastest pace since 2006, as builders recovered from the extreme cold in February. The report also showed that applications for building permits, a good sign of future activity, rose 2.7% to a seasonally adjusted annual rate of 1.77 million units.

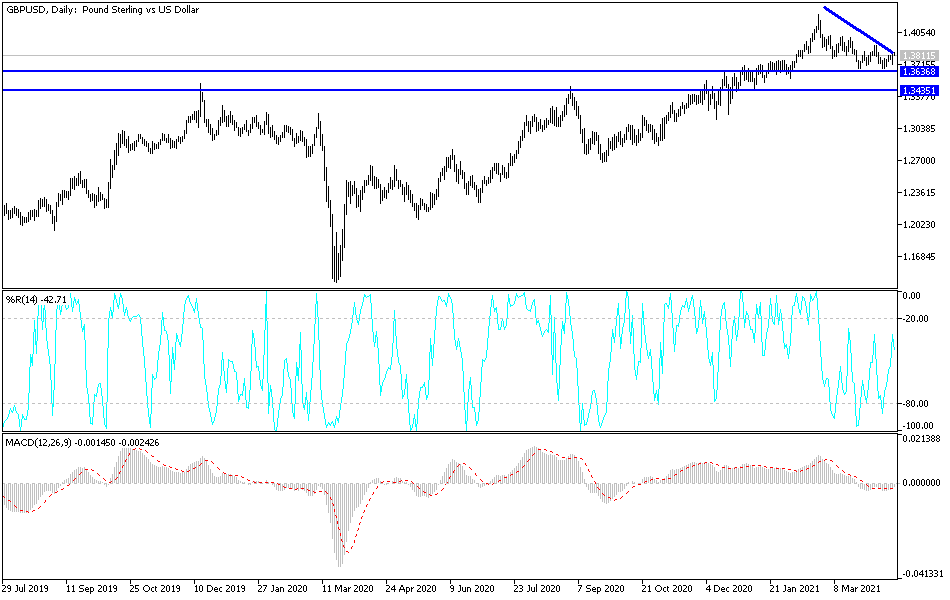

Technical analysis of the pair:

Despite the upward rebound attempts during last week's trading, the GBP/USD pair is still in need of more momentum to make a significant breakout to the upside. Therefore, bulls are eyeing 1.4000 the psychological resistance, as a move below the 1.3800 support level will support the bears again. Still, I prefer to buy the currency pair from every downside.

The currency pair does not expect any important economic data, whether from Britain or the United States, and accordingly, investor risk appetite, the path of global stock markets, and restrictions and vaccinations against COVID will affect the performance of the GBP/USD today.