It was natural, with the GBP/USD pair moving to the 1.4000 psychological resistance amid a sharp upward rebound, to be followed by profit-taking. Indeed, the bears moved the currency pair to the support level of 1.3885 before stabilizing around the level of 1.3935 at the time of writing. The pair is awaiting more momentum to complete the correction path to the upside or vice-versa. In general, the factors behind further gains for the British pound still include Britain's advanced progress in vaccinations and easing of restrictions, which pave the way for a rapid economic recovery from the effects of the pandemic.

In the same expectations, technical analysts at Commerzbank say that they still have strong confidence that the British pound will maintain a bullish trend against the dollar.

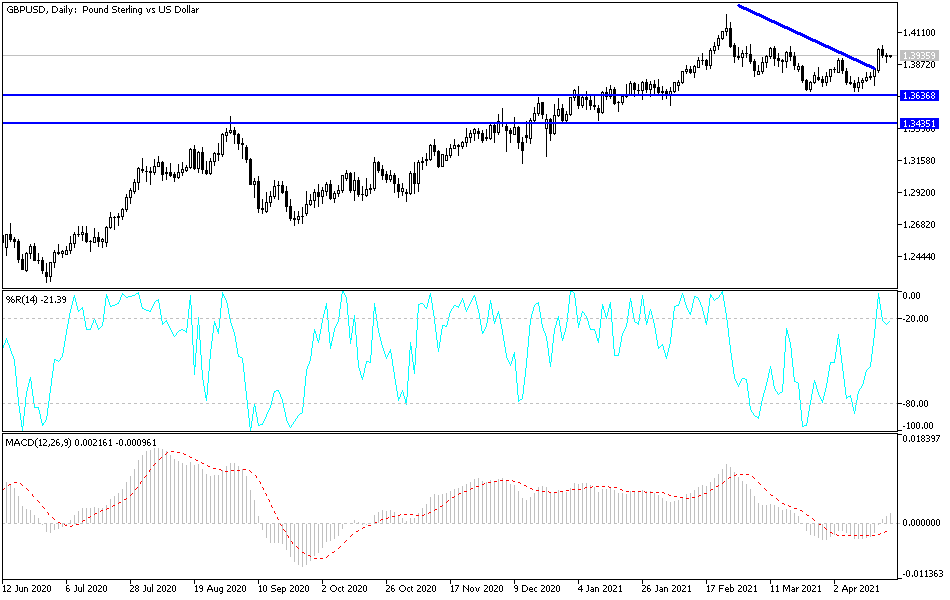

Questions about the upside in the British pound increased over the course of March and April as the broader recovery movement was halted, with the GBP/USD pair collapsing from its February highs above the 1.42 high and back to lows in the 1.3670 support zone in March and April. Commenting on the performance, Karen Jones, Head of Technical Analysis Research at Commerzbank AG, said that the GBP/USD exchange rate “held up for 9 months and reconfirmed its upward movement”. "Our bullish bias is reinforced by the golden cross on the weekly moving averages," she added.

“The GBP/USD pair has reconfirmed its upward movement after recovering ahead of the 9-month uptrend,” Jones said in a weekly briefing on technical expectations for clients. Accordingly, this special set of research and forecasts provides investors with a long-term perspective on how the financial markets will develop and discount the “most loudest” short-term developments.

Closing above 1.4018 will target 1.4245, the latest rally and the highest price since March 2018. On the downside, we expect initial support at 1.3859, the 55-day moving average and 1.3717, the mid-April low, which will be contained by the nine-year rising trend line at 1.3660.

On the other hand, demand for protection from the devaluation of the pound fell to a new low in a post-Brexit trade deal, according to Thomson Reuters data. The data show that the purchase premium for protection against dips in the British pound fell to its lowest level since late 2020, when the cost of such protection rose before the EU-UK trade agreement was signed.

Developments in the options markets - as companies, institutions and investors hedge their exposure to the currency market - point to a reduction in the cost of insuring against fluctuations in the British pound. The decline in demand for hedges from the downtrend reflects a declining market belief in the potential for destabilizing and unpredictable declines.

Technical analysis of the pair:

On the daily chart, the psychological resistance of 1.4000 will remain crucial for a bullish performance, and will support more buying positions to push the currency pair to stronger ascending levels. The closest resistance levels currently for the pair are 1.3985, 1.4045 and 1.4165. The pair's recent gains succeeded in breaking the recent downward trend that pushed it towards the support level of 1.3670, from where we strongly recommend buying. I still prefer to buy the currency pair from every downside.

After the important British economic data recently, today's focus will be on US economic data, including weekly jobless claims and existing US home sales.