In its best trading session this year, the GBP/USD broke through the 1.4000 psychological resistance today. This move warns of a price explosion at any time, as the British progress in vaccinations and easing COVID restrictions will accelerate the pace of the economic recovery from the effects of the pandemic.

The gains of the GBP/USD pair comes just before the announcement of jobs and wages data on Tuesday, and then inflation figures on Wednesday. It may be Friday's April PMI survey readings that provide a better guide to the markets given that it will be just in time. PMIs are the most relevant set of data available to the market and investors will be looking for signs that removing COVID-19 restrictions this month is leading to a revival of economic activity.

The British pound has been bought in recent months as investors are betting that the British economy will recover again in a strong way in 2021 as it recovers from the COVID-19 pandemic. The key to this recovery has been the UK's rapid vaccine rollout program that is now leaving more than 60% of the adult population immune and giving more investor confidence that the reopening will be permanent.

Accordingly, a research briefing note from SEB says: “The economic outlook in the UK has improved significantly over the past months due to successful vaccination programs. This led to a rapid rise in the value of the British pound.”

In general, the way in which the pound moves against the rest of the major currencies during the remainder of the month may depend on whether this regulation has completed its full course. Therefore, seasonality may be a deciding factor for the British pound in the coming days, as it tends to rise in April. Historical data show that the last part of the month is particularly bullish for the British currency.

April is usually bullish for the British pound, as the data indicate that gains tend to occur towards the end of the month, so there may be a seasonal factor to take into account. “April appears to be historically strong for the UK,” says Jordan Rochester, Forex strategist at Nomura. With the seasonal effect of April emerging in the GBP/USD pair, there needs to be support to keep the GBP bullishness intact. Also, Forex analysts at Barclays Bank say they are confident enough of the pound's prospects that they are embarking on a "deal of the week" that seeks to profit from any recovery against the euro.

In a weekly strategy briefing for investment banking clients, Barclays Bank analysts say they believe the recent drop in the value of the British pound is overrated and recommend starting a “sell” on the EUR/GBP exchange rate, with a target of the decline at 0.8560. This equates to a bullish target of 1.1682 for the GBP/EUR.

Barclays says the recent drop in the pound against the euro "is not supported by fundamentals, so expect some correction."

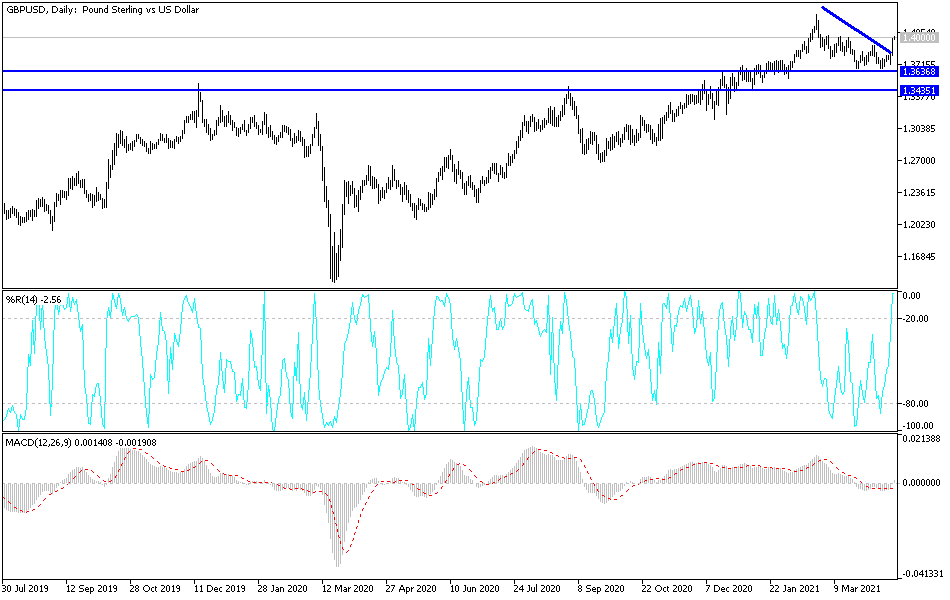

Technical analysis of the pair:

The breach of the 1.4000 psychological resistance is very important for the bulls to control the performance of the currency pair. As shown on the daily chart below, the pair has succeeded in breaking the downward trend and is preparing to form a strong ascending channel closest to the bulls' targets currently at 1.4065, 1.4120 and 1.4200. On the downside, there will be no change in the general trend without the pair returning below the support level of 1.3745. I still prefer to buy the currency pair from every downside.

After the announcement of the jobs and wages numbers in Britain, the currency pair does not expect any important US data.