Selling the pound in the Forex market has not been witnessed since December 2020. The GBP/USD currency pair retreated to the support level at 1.3723, after attempting to bounce back at the beginning of this week's trading towards the 1.3918 resistance level. The main suspected driver of the losses may be the impending loss of momentum in the UK's vaccine launch program.

On Wednesday, the UK medical regulator issued a temporary ban on the AstraZeneca vaccine for people under 30, the latest in a series of disappointments in the nation's vaccination program. The leaked data indicate that the AstraZeneca vaccine will account for three-quarters of the expected supply in the United Kingdom, with some commentators suggesting that the vaccination campaign in the country could effectively halt and delay the government's plans to open the country.

The expectations are that the rapid vaccination program will lead to the continued openness of the country's economy and thus raise investor sentiment towards the pound. But with the vaccination campaign now slowing down, the bullish stance of the GBP may be questioned by investors. Valentin Marinov, analyst at Credit Agricole, said: “It doesn't seem like there are many positives left for the British pound, especially if one looks beyond the positive seasonal effect in April. Indeed, a slowdown in the pace of COVID vaccinations in the UK may ultimately delay the government's plans to reopen the economy despite recent statements by British Prime Minister Boris Johnson.”

Both European and UK regulators have conducted reviews of reports of rare strokes in people who have received the vaccine, as the European Union Regulatory Authority (EMA) confirmed on Wednesday that the vaccine should continue to be used.

But in the UK, an alternative to the AstraZeneca vaccine is now slated to be offered in the 21-30 age group due to the evidence linking it to rare blood clots, according to the UK Vaccine Advisory Authority MHRA. The regulator said this was not yet evidence that the vaccine caused the clots, although the connection became more apparent. The regulator said that side effects are extremely rare and the effectiveness of the vaccine has been proven.

It also said that means the benefits of taking the vaccine are still very favorable for the vast majority. The UK has already seen a sharp slowdown in the vaccine delivery schedule over the Easter weekend, but the lackluster vaccination rate on Tuesday underscores a more structural problem.

The UK government warned in March that the program would slow in April due to supply disruptions, with a planned halt to a planned shipment of 5 million doses from India being seen as the main cause of the stumbling block. However, the early delivery of Moderna vaccines for two weeks and the projection of Novavax supplies to come into service in May may achieve the government's goals of having a vaccine for all adults by July.

Accordingly, Deputy Chief Medical Officer in England Jonathan Van Tamm said, "The impact on the timing of our general program should be zero, or minimal."

The UK services sector posted a strong recovery in March as activity, new orders and employment rebounded from February, the final data from IHS Markit showed. The Services PMI rose to a reading of 56.3, from a reading of 49.5 in February. The result was above the unchanged 50.0 level for the first time since October 2020. The latest reading also indicated the fastest rate of production growth for seven months.

Survey respondents linked higher levels of activity to a recovery in business and consumer spending, while some parts of the service economy commented on a boost in residential real estate transactions in March. The survey showed that strong customer demand and forward reservations ahead of the easing of lockdown measures contributed to the increase in total new business for the first time in six months.

Driven by forward bookings and improving confidence about the business outlook, job creation increased at the fastest rate since 2019.

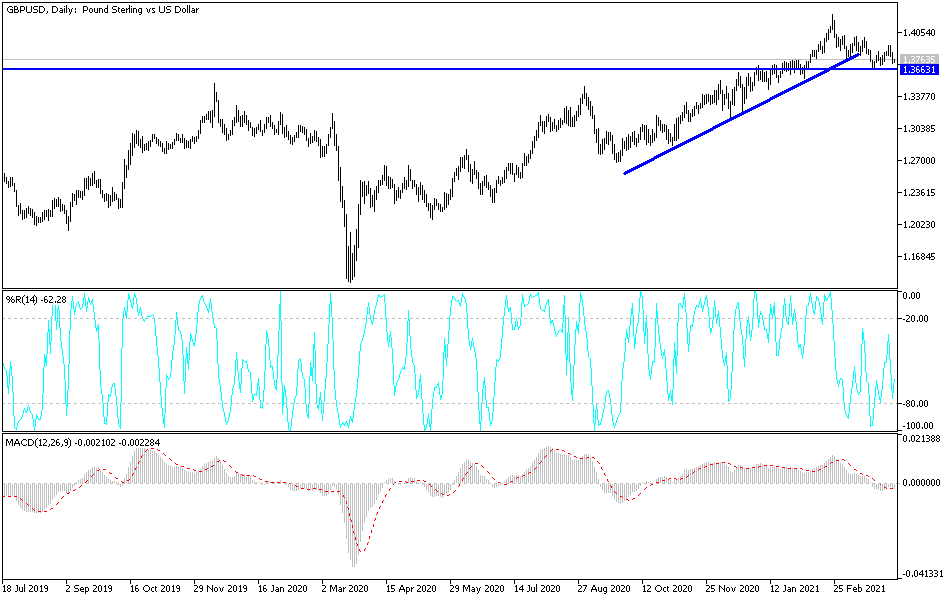

Technical analysis of the pair:

On the daily chart, a breakout occurred for the bullish trend of the GBP/USD by stabilizing below the support level of 1.3800 and the bears are now trying to breach the next important support level at 1.3690, which increases the control of the bears on the performance at the same time. I see it as an opportunity to think about buying the currency pair as the British government is working to continue to excel with a vaccination plan that supports the rapid opening of the British economy, which will be distinctive for the British pound.

On the upside, the currency pair still needs to breach the 1.4000 psychological resistance to return to the path of its sharp ascending channel and hold on for several months in a row.

On Monday, the pound will await the path of stock markets and the announcement of the UK Construction PMI reading. Then the US weekly jobless claims and statements by Fed Chairman Jerome Powell will be announced.