Risk appetite and a focus on British vaccinations contributed to the GBP/USD moving towards the 1.3925 resistance level in an attempt to stick to the bullish trend. The Forex market will be greatly affected by the US Federal Reserve's announcement of its monetary policy decisions and the comments of its Chairman Jerome Powell. Amid the absence of any important UK data in the economic calendar, the dollar's reaction will determine the path of the currency pair.

Generally, amid expectations that the Fed will maintain its monetary policy preparations, Powell must convince the markets that the Fed will stick to higher inflation expectations, despite the improved growth outlook facing the US economy, in order to calm speculation about early declines in asset purchases and continued early rise in interest rates.

In return, the Bank of England will likely follow the Bank of Canada and gradually reduce its quantitative easing program next month, according to an analysis from NatWest Markets. NatWest says the BoE will likely announce at its May 6 meeting that it intends to reduce the pace of its acquisition of bonds under its quantitative easing program, which will further push up the yields on the debt securities.

The Bank of Canada (BoC) became the first global central bank to announce such a policy at its April meeting, which took place last week.

The move has been cited by analysts as a prominent driver of the Canadian dollar's outlook recently, and those monitoring the pound's exchange rates will look to a similar reaction. So John Briggs, analyst at NatWest Markets says: “The business has started with recycling. Of course, it wasn't the Federal Reserve or the European Central Bank that started it, it was the Bank of Canada. ”

On Wednesday, the Bank of Canada cut its quantitative easing program from 4 billion Canadian dollars to 3 billion dollars a week. Accordingly, Briggs says: "I think it is important because it may begin to put the next phase of 2021 in the minds of investors, which is the phase of gradual decline. As the Bank of Canada begins a gradual season, I expect the BoE in May to shift investor attention completely to the issue."

Also, Briggs says in a weekly customer research brief that he expects the Bank of England to announce in May a cut to quantitative easing from 18 billion pounds a month to 14 billion pounds a month. This reduction will be helped by a large deficit in borrowing requirements by the government and "also by the fact that the Bank of Canada led the way."

Recent survey data showed that the UK economy is in recovery after restrictions have been eased in recent weeks, and economists are expecting the pace of the recovery to accelerate as further easing is allowed in May and June. For its part, the UK government's Debt Management Office indicated a 14.6% decrease in total debt securities issuance as the government's demand for borrowed funds declined.

The Centers for Disease Control and Prevention relaxed its guidance yesterday on wearing masks outdoors, saying that fully vaccinated Americans do not need to cover their faces anymore unless they are in a large crowd of strangers, and those who haven't been vaccinated can go out without a mask in some situations as well. The new guidelines represent another carefully calibrated step on the way back to normal from the coronavirus outbreak that has killed more than 570,000 people in the United States.

For most of the past year, the CDC has been advising Americans to wear masks outdoors even if they are not within 6 feet of each other.

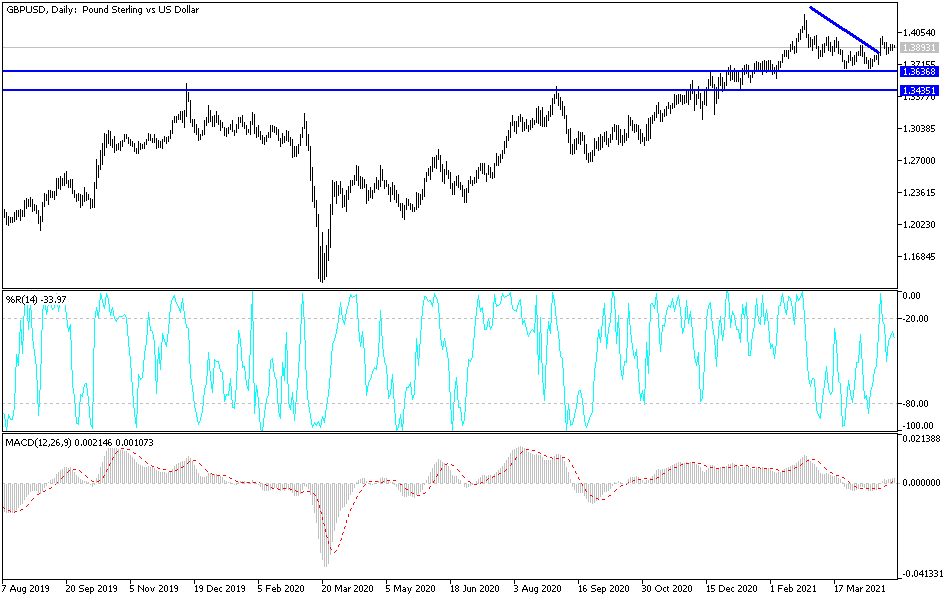

Technical analysis of the pair:

On the daily chart, the GBP/USD is still within its ascending channel. A bullish move to breach the1.4000 psychological resistance level will encourage buying to test stronger highs that confirm a longer continuation of the current trend. The gain factors are increasing. The bears' control over the performance will be strengthened in the event of a move below the 1.3720 support. All in all, I would still prefer buying the currency pair from every downside.