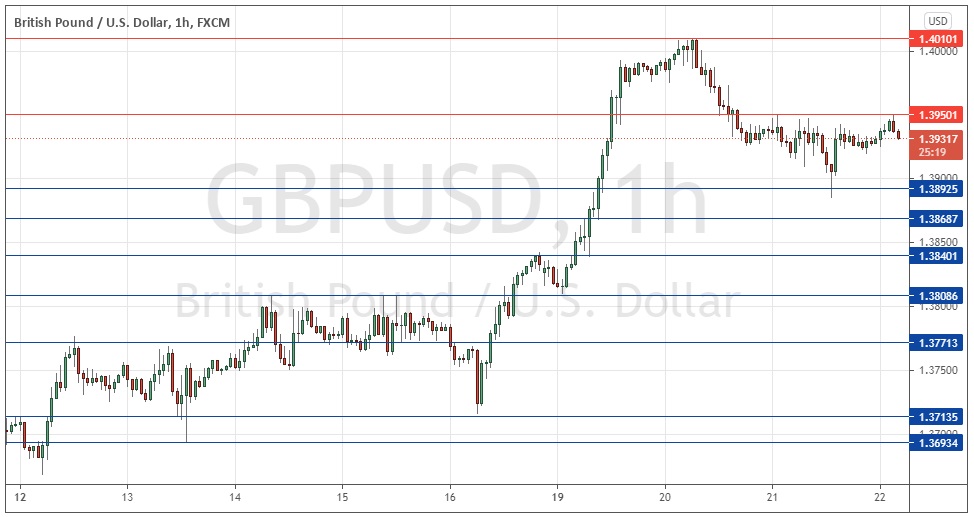

Yesterday’s GBP/USD signals were excellent, producing both a profitable short trade from 1.3949 and a profitable long trade from 1.3889.

Today’s GBP/USD Signals

Risk 0.75%.

Trades may only be entered between 8am and 5pm London time today.

Short Trade Ideas

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3949 or 1.4008.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3893, 1.3867, or 1.3840.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote yesterday that I saw the best potential opportunity today as a continuing fall to either of the two nearby support levels, ideally the lower one at 1.3867, and then a long trade from any bullish bounce there.

This was a good call, as the price fell to the first support level, and made a bullish bounce there which sent it back up to touch the nearest resistance level at 1.3950 a few hours ago. Both the nearest support and resistance levels held.

It seems that bulls and bears are likely to be evenly matched, although it does look like we have a firmer bearish reversal now from 1.3950 which seems to be pushing the price down, so the short-term outlook suggests the price will fall now to the nearest support level at 1.3893.

The major monthly policy release from the European Central Bank is due today so this could cause turbulence in the price of the pound as a knock-on effect from the euro, with which tends to be quite closely correlated. Apart from this factor, it looks likely that this currency pair could be a good short-term buy from a firm bullish bounce rejecting 1.3893 and ideally quickly popping back up above the round number at 1.3900 at the same time, or a good (probably short-term) sell at 1.3950 which seems to be established as firm resistance. Even if the price reached the next higher resistance level at 1.4010, a bearish reversal there would also give a very attractive short trade.

There is nothing of high importance due today concerning either the GBP or the USD.