Bullish View

- Place a buy trade and set the take-profit at 1.1400.

- Add a stop-loss at 1.3900.

- Timeline: 1 day.

Bearish View

- Place a sell-stop at 1.3920 (April 6 high).

- Add a take-profit at 1.3880 (this week’s low).

- Add a stop-loss at 1.400.

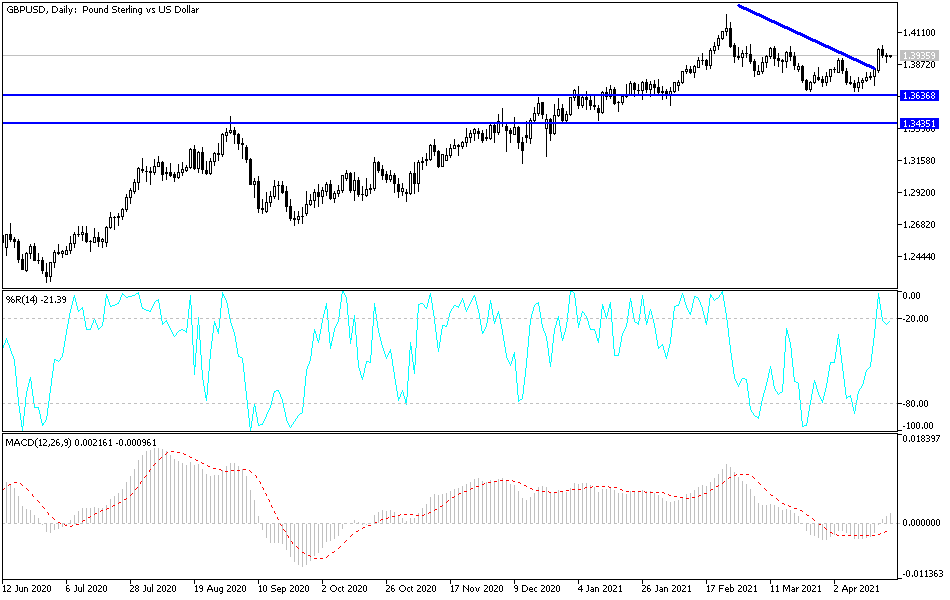

The GBP/USD has bounced back from its lowest level yesterday as the market reflects on the recent data from the UK. It is trading at 1.3945, which is slightly above this week’s low of 1.3885.

UK Economic Recovery

Recent economic numbers from the UK show that the country is in a fast recovery mode. On Tuesday, data revealed that the country lost fewer jobs in February than estimated. The unemployment rate also declined to 4.9% while analysts were expecting it to rise to 5.1%.

On Wednesday, data by the ONS showed that consumer and producer prices are gathering momentum. The headline CPI rose from 0.4% to 0.7% on a year-on-year basis. The core CPI, which excludes the volatile food and energy products, remained unchanged at 1.7%. The PPI input and output rose by 5.9% and 1.9%, respectively.

These figures will likely keep rising as the UK reopens and as crude oil prices remain at elevated levels than last year. The country has started to reopen while the number of coronavirus cases has continued to fall. As such, some of the businesses that were forced to close like hotels, restaurants, and entertainment spots will likely lead the recovery.

The GBP/USD pair will today react to the latest initial jobless claims and existing home sales numbers from the United States. Economists expect that the number of Americans who filed for unemployment insurance rose from 576,000 to 617,000. They also see the continuing jobless claims falling from more than 3.73 million to 3.667 million.

The housing stats will also have a modest impact on the GBPUSD price. The median estimate by analysts is for the existing sales to fall from 6.22 million to 6.19 million. Tomorrow, the country will publish the new home sales numbers.

GBP/USD Technical Outlook

The GBP/USD price rose to a high of 1.3945, which is slightly below this week’s high of 1.400. On the hourly chart, the pair has moved above the 25-period and 15-period exponential moving averages (EMA). It has also moved above the 23.6% Fibonacci retracement level and the first support of the Andrews Pitchfork tool. The Awesome Oscillator has also moved slightly above the neutral level. Therefore, the upward momentum will likely continue as bulls attempt to retest the highest level this week.