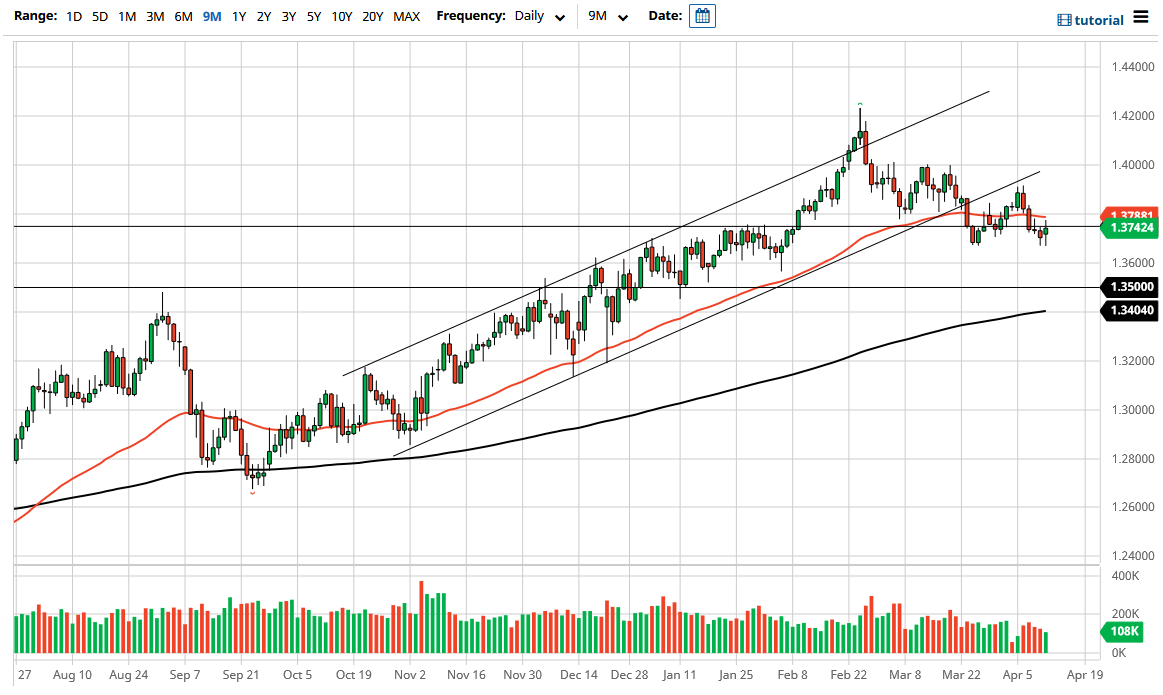

The British pound did have a positive session on Monday, but more than anything else you could say it was a “stabilizing day.” While this is a relatively good sign, the reality is that we have not been able to break above the 50 day EMA. I find this interesting, because the 50 day EMA had previously been offering a bit of an uptrend line, and now it looks as if it is trying to dictate where we go next. The 50 day EMA is essentially flat, so it should not be a huge surprise to see that the market is essentially the same.

All that being said, the 1.3750 level has been important more than once so that is another thing that does not surprise me to see at the moment, the market hanging around this area. The candlestick looks a little bit like a hammer, but if we can break above the top of the 50 day EMA on a daily close, then it is possible that the market could go looking towards the 1.40 level above, which has been crucial support and resistance multiple times throughout the past. Most recently, the 1.40 level has been like a brick wall, so breaking above there would obviously be a very bullish sign.

Just underneath, there is a significant amount of support right around the 1.3650 level, but even if we were to go down below there, the market is likely to go looking towards 1.35 handle. The 1.35 handle is a large, round, psychologically significant figure, and the bottom of a major zone of support. If we were to break down below there, then I believe at that point the trend itself would turn around and we would probably continue to go much lower.

Currently, if the market were to turn around and rally, the 1.40 level above could then open up the possibility of moving towards the 1.42 handle. The 1.42 level is an area that we have pulled back from and shown an extreme amount of selling pressure, so a pullback and then a re-capture that area would be a very bullish sign. If we were to break above there, then it is likely that the market goes looking towards the 1.45 level next due to the longer-term charts. Currently, it looks as if we are trying to build a bit of a base.