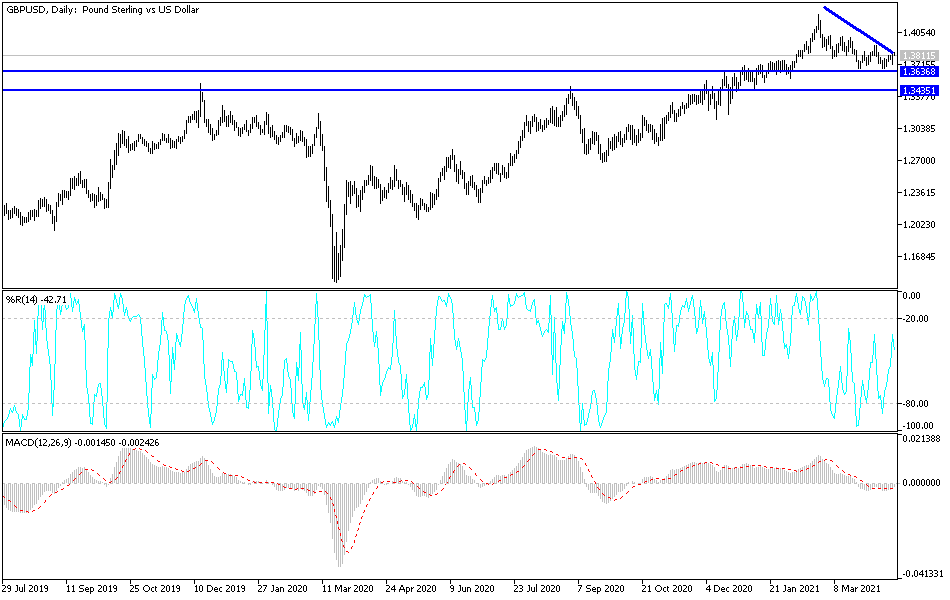

The British pound initially pulled back during the trading session on Friday to reach down below the 1.3750 level, only to turn around and show signs of strength again. As you can see, we are closing at the very top of the candlestick and that is a bullish sign. However, I have also drawn a short-term downtrend line that is something worth paying attention to, because it is right where we stopped. If we were to break above that downtrend line, then I believe that the British pound will continue to go much higher, perhaps reaching towards the 1.40 level. That is an area that I think will continue to be very important, so if we were to reach that level, I would anticipate a lot of profit-taking.

On the other hand, if we break above the 1.40 level, then it is likely that the market will go much higher, perhaps reaching towards the 1.42 handle. The 1.42 handle has been a massive resistance barrier that has been difficult to break through recently, so it will be interesting to see how that plays out. Having said that, the market has a lot of work to do before we can get anywhere near that level, so it makes sense that the market will continue to have a lot of fight ahead of it.

Looking at this chart, if we were to turn and break down below the recent lows at that “double bottom”, that would kick off a descending triangle that could spell more trouble for the British pound. I still think the 1.35 level would be massive support, though, as it is a large, round, psychologically significant figure and where the 200-day EMA is reaching towards, so I think this is a market that will eventually have to make a bigger decision when it comes to the next move. The one thing you can probably count on is a lot of volatility, so you need to be cautious about your position size, at least until we get some type of impulsive candlestick that we can use to put money to work. It is worth noting that the overall trend is higher as of late, but the 1.42 level is near a major top from previous trading years ago.