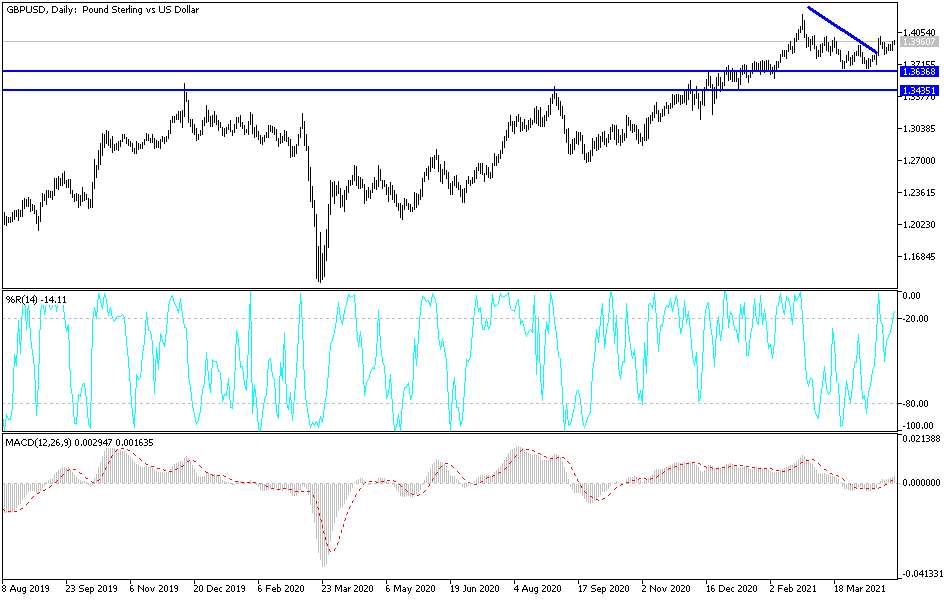

The British pound initially pulled back a bit during the trading session on Wednesday, but then turned around as Jerome Powell suggested that the Federal Reserve is nowhere near trying to tighten monetary policy or even slow down bond purchases. At the end of the day, we have closed towards the top of the range, perhaps reaching towards the 1.40 handle. That is an area which the market continues to respect as a major resistance barrier, so we need to close above there on a daily candlestick in order to get bullish for a bigger move. If that happens, then we are likely to go looking towards the 1.42 handle above.

Looking at this chart, the 50-day EMA underneath continues to offer support, so it is likely that we will continue to see buyers on dips from what I can see. Furthermore, the double bottom underneath should also offer a certain amount of support that extends down to the 1.35 handle underneath. The 200-day EMA is reaching towards that area as well, and it will more than likely be greatly influential if we get down to that area.

n the meantime, I think we will continue to buy short-term dips, but it is going to be choppy more than anything else. After all, the US dollar is kind of all over the place, and as Federal Reserve Chairman Jerome Powell has passed on anything remotely along the lines of tightening, I think that eventually we will continue to see that move; but it is also worth noting that the market does not seem to have anything to do in the short term.

With this being the case, I think that the market will eventually build up momentum, but right now we just do not have the catalyst to get anywhere. We have been working off a lot of froth from the recent grind higher, as we are trying to reset the entire trend, perhaps reaching towards the aforementioned 1.42 handle. If we can break above there, then we will go looking towards 1.45 handle. That being said, if we were to break down below the 200-day EMA, then the trend will be down, perhaps reaching this market much lower, maybe down to the 1.30 handle or even further.