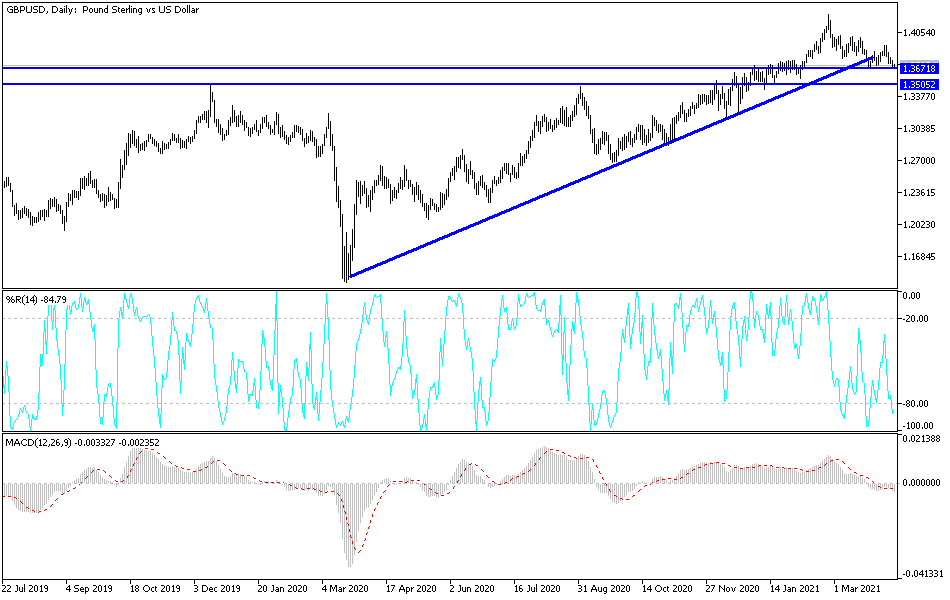

The British pound fell significantly during the trading session on Friday again, only to turn around and form a bit of a hammer. This is a market that has been hanging about the 1.3750 level for a while, and as a result it is very likely that we will continue to see choppy and noisy trading in this scenario. If we were to turn around and break to the upside, I see significant resistance, just as I see plenty of support underneath due to the candlestick for the trading session on Friday.

Furthermore, the support underneath the candlestick also extends all the way down to the 1.35 handle, so I think that it is only a matter of time before the buyers come in and try to save the British pound. The 200-day EMA is currently at the 1.34 handle and trying to get to the 1.35 level, so that will come into the picture as well. Because of this, I think that if you are patient enough, we will get an opportunity to start buying, perhaps either on a break above the 50-day EMA, or some type of supportive candlestick underneath.

It is worth noting that the weekly candlestick does not look that hot though, so I think that given enough time we will see buyers underneath in order to get involved. However, if we were to break down below the 1.35 level, then we may have further to go to the downside. Until then, this is simply a market that is pulling back and trying to build up enough momentum to continue going higher. The astronomical amounts of spending coming out the United States could continue to work against the value of the US dollar longer term, but until we get some type of momentum, it is difficult to imagine a scenario in which we will have easy trading. In the short term, traders are concerned about the UK itself, but it also has been far ahead of most of its peers when it comes to the vaccination program, which then should lead to the British economy opening up and strengthening along the way. At this point, though, we are simply grinding away trying to find a certain amount of stability before going forward.