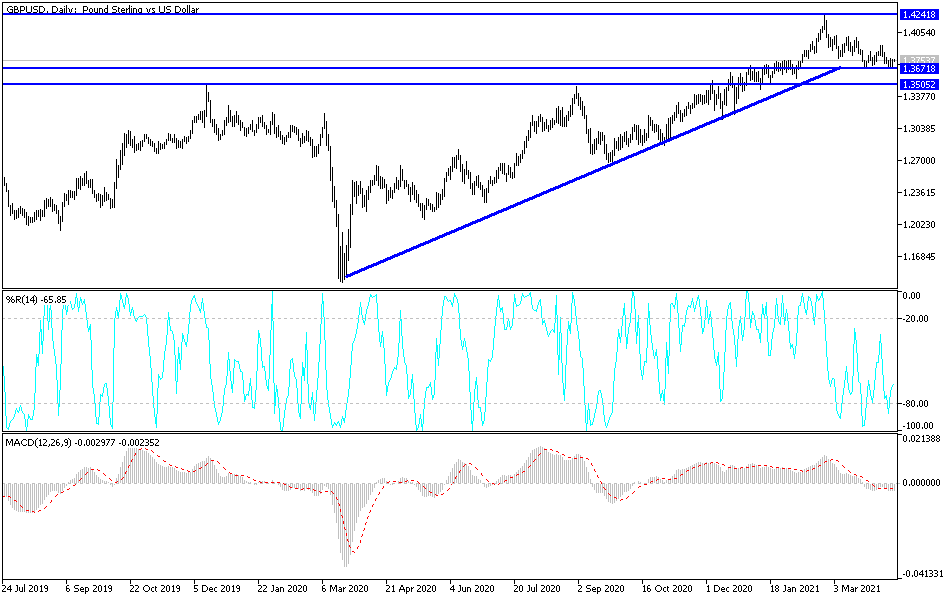

The British pound has been all over the place during the session on Tuesday, as the 1.3750 level continues to be a bit of a magnet for price. If that is going to be the case, then it makes sense that we have formed a couple of neutral candlesticks in a row. We also have the 50-day EMA sitting just above, which is something worth paying attention to. The 50-day EMA does tend to attract a certain amount of technical support and resistance, so it has something to say about where we go next, at least in theory.

Looking at the candlestick, you can see that we tried to make a low, but we could not do so. With that being the case, I think it makes sense that we would see choppy behavior, but if we do break down below the lows of the last couple of sessions, that would break a “double bottom”, perhaps opening up the possibility of a move down to the 1.36 handle, even down to the 1.35 handle over the longer term.

On the other hand, if we were to close above the 50-day EMA on a daily candlestick, then I think the market will go looking towards the 1.39 level next. After that, the market is likely to go looking towards the 1.40 level, an area that has been a large, round, psychologically significant figure, and an area that will be very difficult to break above based upon what we have seen as of late. If we do, that could send this market towards 1.42 handle, which is a major resistance barrier on the longer-term charts.

That being said, it is obvious that the market has struggled as of late, so I think we need to see some type of reason to get bullish again. Right now, I think this is simply going to be a bunch of range-bound trading, and therefore not necessarily overly exciting. Short-term back-and-forth trading may be possible, but until we break one of the levels that I have mentioned previously in this article, it is difficult to put a ton of money to work. I think short-term back-and-forth choppy behavior is probably what you can count on in the short term.