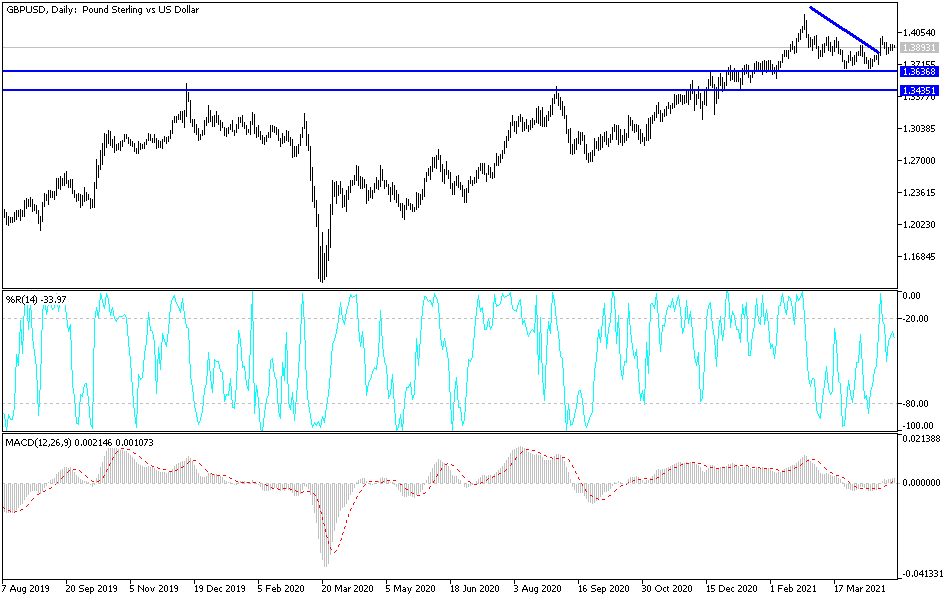

The British pound fell during the trading session on Tuesday but found buyers underneath to get the market back to the upside. We ended up closing just above the 1.39 handle as New York shut down, suggesting that perhaps we are going to make another attempt for the 1.40 level yet again. This is an area that has been very difficult to overcome, but the market is still very much in an uptrend, and that is something that should be paid close attention to. After all, the overall trend has been very bullish for some time until recently, so one would have to think that this might be more or less a bit of volatility/consolidation to break out above a major barrier.

The 50-day EMA sits just below current trading, so it is a technical indicator that I think a lot of people will be paying close attention to. With that in mind, I like the idea of buying dips as we continue, but I did state that perhaps this could be a very difficult market in the short term. Long term, it is obvious that there are a lot of buyers underneath, and it does appear that the US dollar continues to get hammered against almost everything. With the massive amounts of stimulus and spending coming out the United States, it is hard not to imagine a scenario where the US dollar could continue to be on its back foot.

On the other hand, there are concerns when it comes to growth, so the British pound may suffer just a bit based upon that. Long term, though, this is a market that I think will eventually manage to break above the 1.40 handle and go looking towards the 1.42 level that had been so important previously. That is an area that if we can break above, it could open up a move to the 1.42 handle. That being said, I do not think it is going to be very easy to get to that level. To the downside, it is obvious that the 50-day EMA is an area that a lot of people will be paying attention to, right along with the double bottom underneath there. After that, then the next support level would be found at the 1.35 handle, which also is attracting the attention of the 200-day EMA currently.