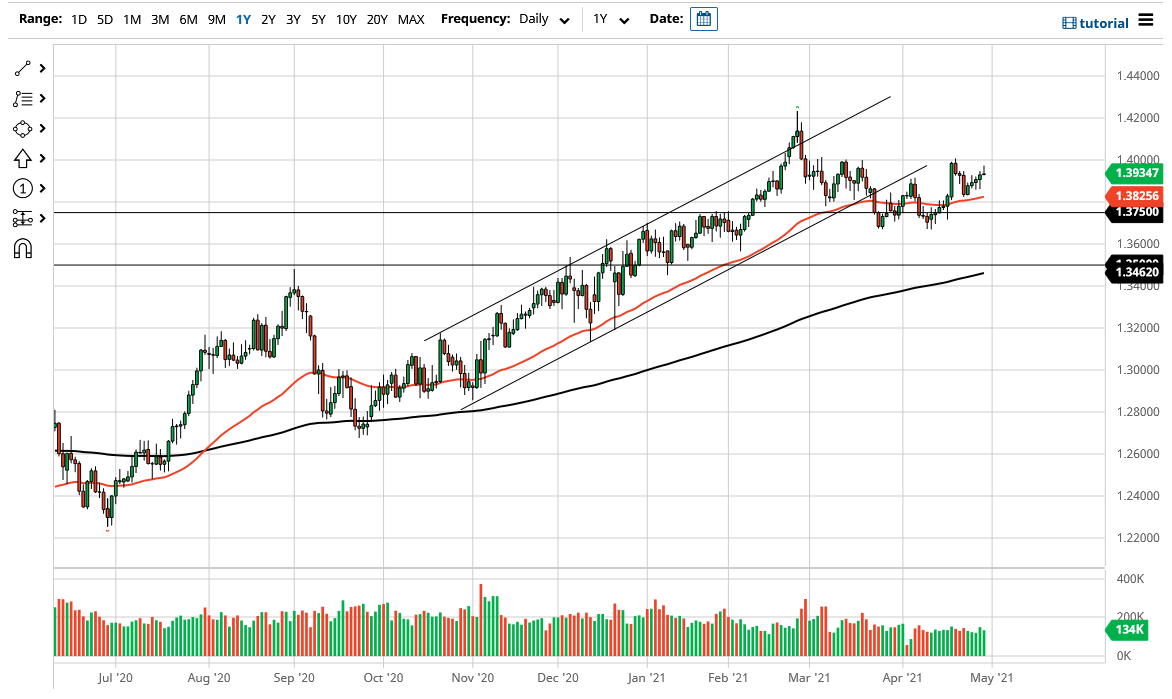

The British pound initially tried to rally during the trading session on Thursday, but then pulled back a bit to form a shooting star. The shooting star sits just below the 1.40 handle, an area where we have seen a lot of pressure previously. I do think that it is going to take a lot to get above there, but if we did it should open up a move towards the 1.42 handle above. In that general vicinity we have seen a massive amount of bearish pressure, and I do think that it would only bring in more selling pressure. The shooting star that formed there would of course be a sign that there is a lot of selling, but the fact that we have pulled back probably just opens up the idea of a base building exercise.

Looking at this chart, you can see that we had formed a little bit of a double bottom and now we have even broken back down below from the initial surge higher to test the 50 day EMA and then turned around to show signs of strength again. Because of this, the market is likely to see choppy and erratic behavior on short-term charts but given enough time I do think that we break out. With this being the case, I think that short-term traders will continue to be attracted to this market, perhaps buying dips as we clearly have a lot of upward pressure.

If we did turn around a break down below the double bottom, it could open up a move down to the 200 day EMA which is rapidly approaching the crucial 1.35 handle. The 1.35 handle of course is an area where we have seen a lot of action in the past, and therefore it should not be overly surprising that the previous resistance now offer support. Ultimately, this is a market that I think continues to see a lot of choppy behavior, but I still think that the safer trade is probably going to the upside as the Federal Reserve is flooding the markets with liquidity and of course the dollar has taken a bit of a hit as a result. We have been in an uptrend for some time, but it now looks as if this has simply been the market working froth off the top.