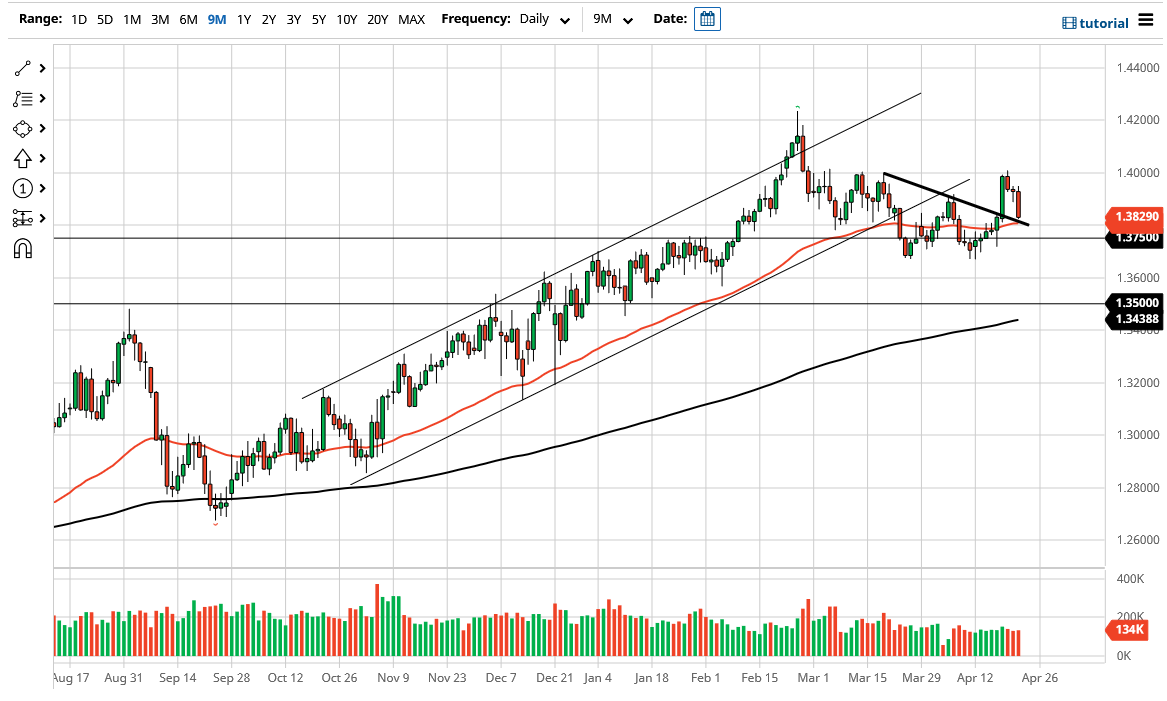

The British pound fell rather hard during the course of the trading session on Thursday to crash back into that uptrend line that has recently been taken out. The selling escalated quite drastically late in the day, as we are now testing not only the previous downtrend line, but also the 50 day EMA. At this point, it looks to me like we are trying to figure out whether or not we can continue to go higher. While this candle does not necessarily spell the end of the uptrend, it certainly is something worth paying attention to.

The fact that we are closing at the very end of the candlestick typically means there is some follow-through, but you can also say the same thing about that massive candlestick earlier this week! The 1.40 level of course offers a lot of resistance yet again, so the question now is whether or not that has become a ceiling? I do not know if that is the case quite yet, but if we break down below the recent double bottom, this market will probably fall apart and go looking towards 1.35 level again.

A lot of what you will need to pay attention to is the bond market in the United States, because of that starts to spike again that will have people rushing towards the US dollar. Beyond that, you also have to pay attention to the UK and the “vaccine passport” idea that is now being kicked around that could seriously restrict the economy. While the United Kingdom has had quite a bit of success in its vaccination program, it may run the risk of shooting itself in the foot if politicians have their way.

I think all this means right now is that we are simply going to chop around and do as much damage to trading accounts as possible. The market gets into these fits sometimes, which means that you need to cut your position size. Unless you have the ability to watch the chart very closely, you simply must find a way to cut down your position size and ride through quite a bit of volatility. As things stand right now, we are still technically in an uptrend but the session on Thursday will have done absolutely nothing to make people feel better about it.