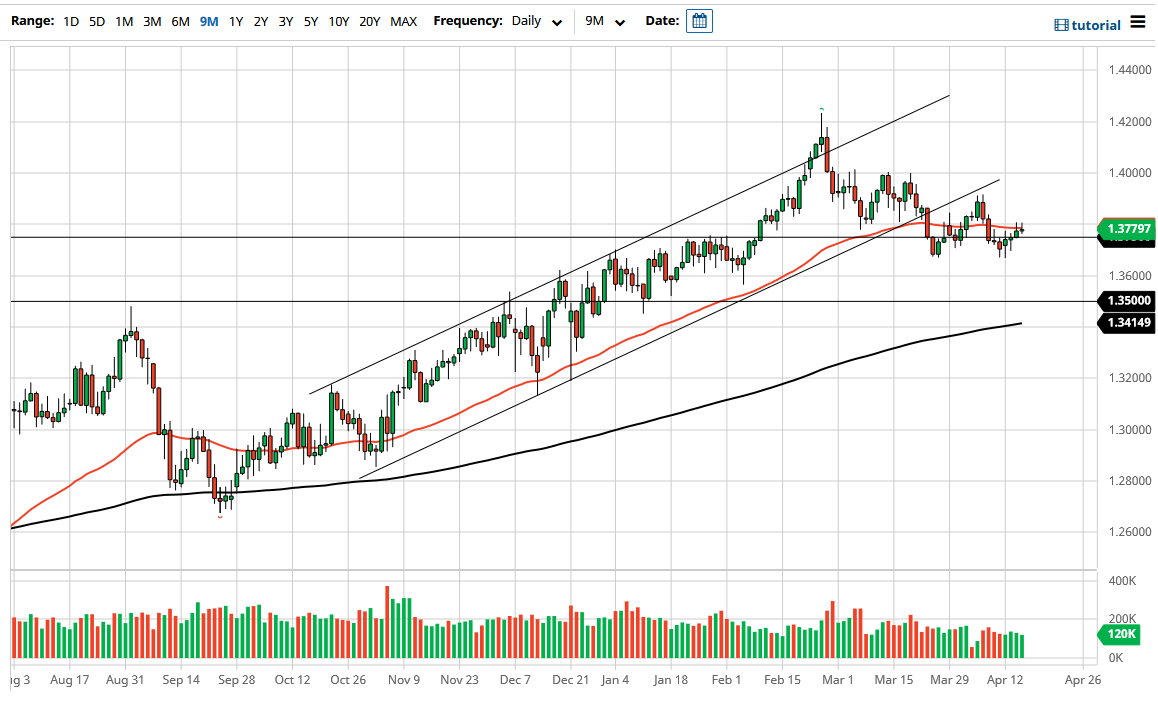

The British pound has tried to rally during the trading session on Thursday but continues to struggle with the 50 day EMA. As we initially rallied and broke above it, sellers came back in to push this market to the downside. The candlestick for the session is more or less a shooting star again, sitting just above the 1.3750 level. The area of course is a previous resistance level, and now is offering significant support. That being said, the market looks as if it is trying to carve out some type of range in this area, perhaps in a bid to try to form a bit of a base.

If the market was to break above the 1.38 level, then the market could go higher, perhaps reaching towards 1.39 level. After that, then we could see the 1.40 level being tested again. That is an area that is not only a large, round, psychologically significant figure, but it is also an area where we have seen a lot of selling pressure previously. That being said, the 1.40 level being broken to the upside could open up a move towards the 1.42 handle, which is an area that has offered significant resistance previously, and therefore I think it would be difficult to simply slice through it.

However, if the market does break above the 1.42 handle, then I believe that the British pound will go looking towards 1.45 handle. That is very unlikely though, just in the short term. That being said, if we were to turn around a break down below the bottom of the double bottom that recently formed, then the market could go down to the 1.35 handle. The 1.35 level of course be a large, round, psychologically significant figure, and of course also brings into focus the 200 day EMA, which is racing towards it. Breaking down below there could completely wipe out the uptrend, but that seems to be very unlikely anytime soon. That being said, if the market were to make that move, it could be rather drastic and negative for the British pound. The US dollar strengthening could be the biggest culprit, but at this point in time it is likely that the market is probably going to be noisy more than anything else, as we continue to see choppy behavior going forward.