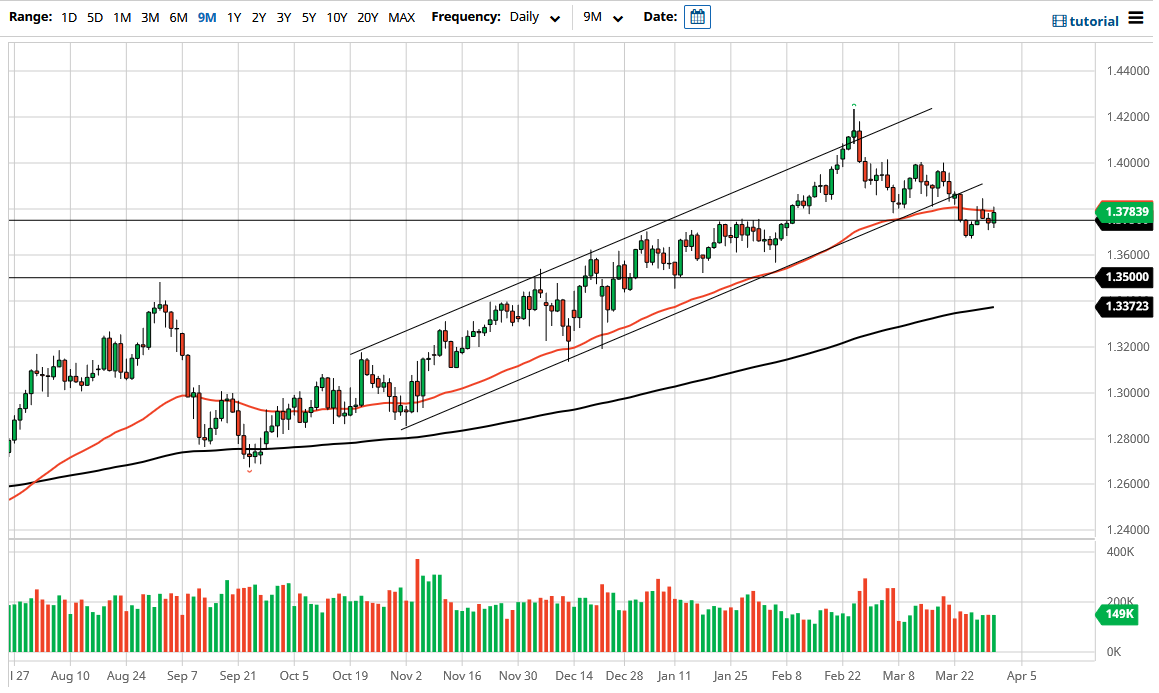

The British pound has gone back and forth during the trading session on Wednesday but settled on a green candlestick as the 1.3750 level is an area that has been important more than once. Because of this, it is very likely that the market will continue to be very noisy in this area, and the fact that the 50 day EMA sits just above will of course continue to attract a lot of attention as well. Nonetheless, this is a market that I think is trying to find its footing, despite the fact that the US dollar has been strengthening against almost everything out there, with perhaps the exception of the British pound.

To the downside, the market sees support at the 1.3775 handle, and if we were to break down below there it is likely that the market could go down to the 1.35 handle where I would anticipate seeing even more support at the 200 day EMA is racing towards it. The 200 day EMA of course is an indicator that a lot of people will be paying close attention to as most traders will look at it as a potential trend defining indicator.

All things been equal, I think it is more likely that we bounce from here than break down and clearing the Monday candlestick to the upside would be a very bullish sign. At that point, the market would probably go looking towards 1.40 level, an area that has been resistance multiple times. Breaking above there then would allow the market to go looking towards the 1.42 handle, which is a major weekly resistance barrier that we recently pulled back from. I do think that the market eventually try to get back to that level, but it may be very noisy in the meantime. That major area is one that is likely to be retested, and if we can break above there then the British pound will continue to go much higher. I do not think that we break down below the 1.35 handle anytime soon, but if we did that would obviously change quite a bit of attitude for traders around the world, and I would have to reevaluate the entire situation in the British pound. With the UK economy opening back up, this might be the one currency pair that favors something other than the greenback at the moment.