The British pound recovered just a bit during the trading session on Friday, but it was not a very impressive candlestick. This is especially true considering that the euro closed at the top of the range for the session and had broken through resistance. The British pound is clearly suffering, and I think what we will continue to see is a bit of a lackluster performance. The US dollar held up pretty well against the British pound as it did against most other currencies, with the exception of the euro.

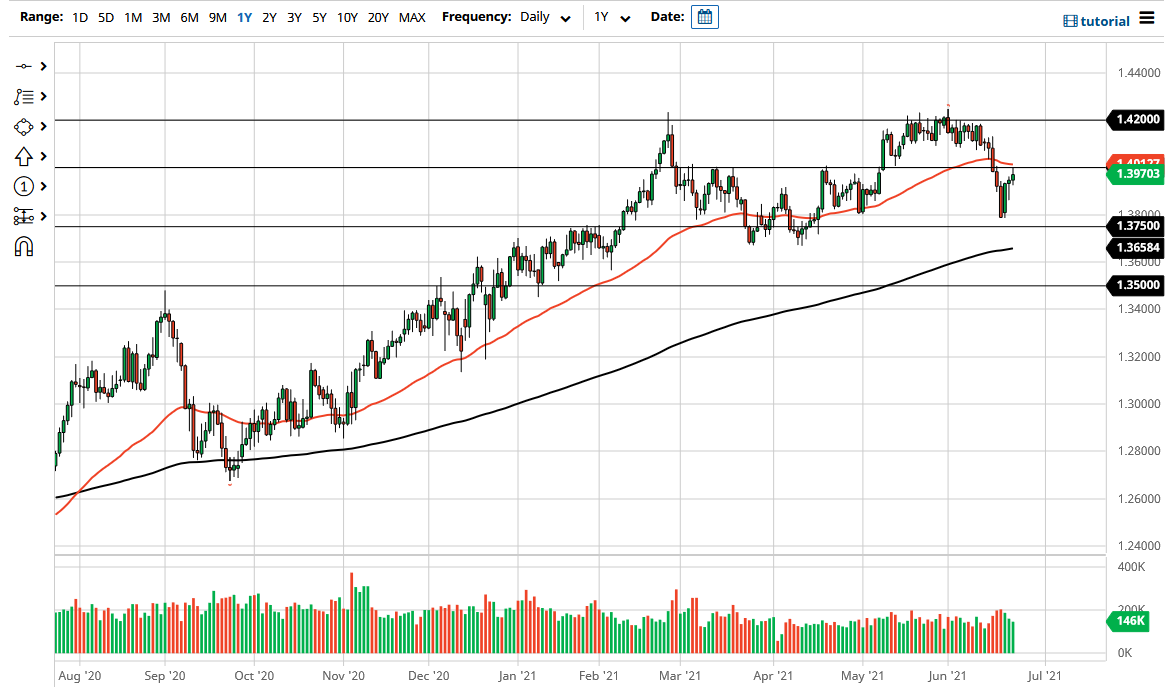

That brings me to my point: the real trade might be to get long of the EUR/GBP pair. Nonetheless, this is a market that I think continues to see a lot of noisy behavior, but still favors the upside eventually. Nonetheless, if we were to turn around and break down below the 1.375 level, that could open up an attempt to break down below that little micro double bottom underneath. Breaking that opens up a move down to the 1.35 handle, where I see the 200-day EMA coming into the picture to offer a bit of support.

Breaking down below that would change the trend and I think the British pound would go really much lower. I think we are most certainly looking at a market that is trying to recover, but really at this point in time it looks like the 1.40 level is massive as far as resistance is concerned, so if we were to break above there then this market would probably go much higher. At that point, the market would probably go looking towards the 1.42 handle. That is an area where there has been massive resistance previously, so if we were to break above there it would continue the longer-term uptrend.

Ultimately, we will have to pay attention to the interest rate differential between the two countries, because we have seen a lot of noise in the greenback against most other currencies, and with the UK having some issues reopening the economy, that could come into play as well. That being said, at the very least, the market probably needs to consolidate and work off some of the froth from the massive move higher we had seen over the last several months. There are a lot of things going on right now, and that should continue to keep things very choppy.