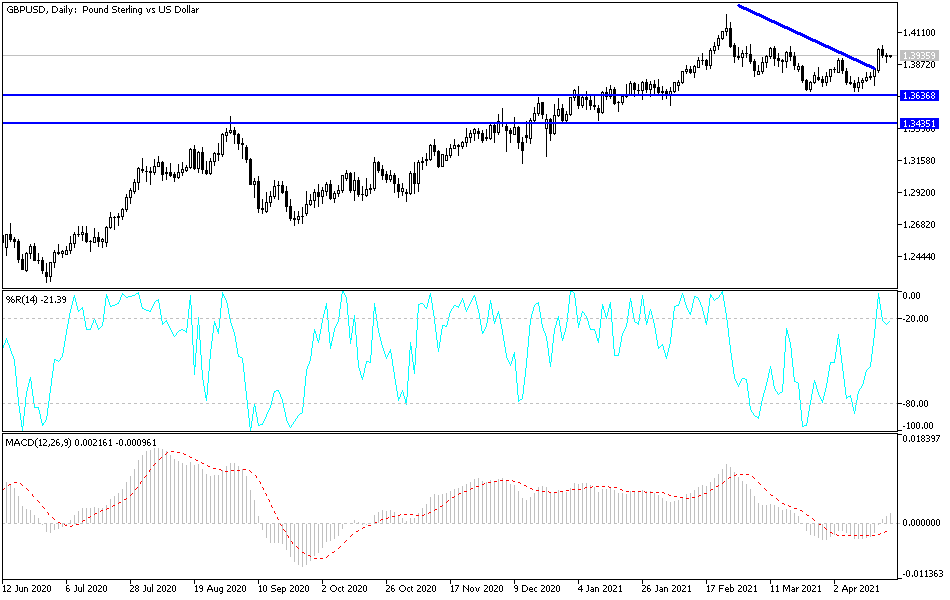

The British pound pulled back initially during the trading session on Wednesday against the US dollar, but then turned around to show signs of strength. This should not be a huge surprise, because we have formed such a bullish candlestick during the Monday session. Pulling back from the 1.40 level the way we have should not be shocking, because it has been a massive barrier to overcome, and we got there far too quickly.

The Tuesday candlestick was a little bit negative, and then we ended up pulling back about half the gains from that massive candlestick on Monday only to turn around and form a bit of a hammer on Wednesday. That suggests to me that we are going to make another attempt to get above the 1.40 level, and if we do, that certainly opens up a much bigger move. Looking at this chart, we are in an uptrend, and it looks as if we are trying to finish a “W pattern”, suggesting that the 1.2750 level has in fact offered significant support.

It is also worth paying close attention to the US dollar, as that is probably the bigger driver of the two currencies right now. As the US dollar continues to get hammered in general, the British pound should be a beneficiary just as other currencies will. It is worth noting that we have been in an uptrend for quite some time, and it looks as if the 50-day EMA has at least attracted a certain amount of attention. With all of this being said, I do recognize that the 1.42 level is a massive barrier, and it would take quite a bit of work to get above there, even more so than the 1.40 level which has been extraordinarily difficult.

The one thing that this chart does tell me is that I have no interest whatsoever in trying to short this pair, at least not yet. In fact, it is not until we break down below the 1.35 level that I would consider shorting. At that point, then I would probably become somewhat aggressive to the downside, but right now we are nowhere near that, and the price action on Wednesday only reinforces the idea that we are going to go higher over the longer term anyway.